Gold prices saw an increase on Thursday, receiving support from a decline in the dollar and lower US Treasury bond yields. Traders, meanwhile, awaited US economic data to gain further insights into the Federal Reserve’s monetary policy expectations. Spot gold rose by 0.4 percent to reach $2,036.60 per ounce as …

Read More »Japan’s Nikkei declines, tracking Wall Street

Japan’s Nikkei index experienced a decline on Thursday, influenced by a significant sell-off on Wall Street and a notable drop in Toyota’s shares due to a growing safety concern within its Daihatsu Motor unit. The Nikkei closed at 33,140.47 points, reflecting a decrease of 1.59 percent. Among the 225 listed …

Read More »Oil is heading to end its winning streak as US inventories rise

Oil prices experienced a decline on Thursday, potentially halting a three-day winning streak. Concerns about reduced demand emerged following an unexpected surge in US crude inventories, overshadowing worries about global trade disruptions due to tensions in the Middle East. As of 0303 GMT, Brent crude futures saw a decrease of …

Read More »Nasdaq Requires Close Examination 21/12/2023

Oil, Crude, trading

Read More »Dow Jones attacks 38,000 and positivity continues 21/12/2023

Oil, Crude, trading

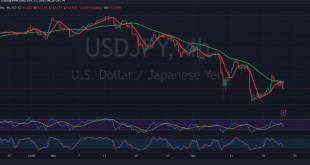

Read More »USD/JPY may continue to fall 21/12/2023

japanese-yen

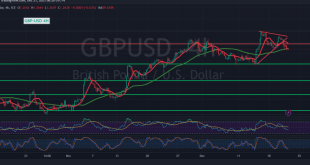

Read More »GBP under negative pressure 21/12/2023

Oil, Crude, trading

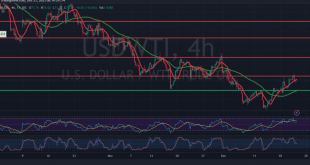

Read More »Oil retests support 21/12/2023

Positive trading prevailed in the US crude oil futures market until midday, reaching the designated target of 75.40 and peaking at 75.35. Technically, examining the 4-hour chart reveals that the 75.40 level is exerting substantial downward pressure on oil, prompting a swift retreat towards 73.54. The negative stochastic indicator is …

Read More »Gold needs more bullish momentum 21/12/2023

Gold prices experienced a temporary downturn following a formidable resistance encounter near 2044, compelling a negative trade that approached the support level highlighted in the preceding report at 2025. The lowest point was marked at 2027 before initiating renewed efforts toward an upward recovery. Upon a detailed examination of the …

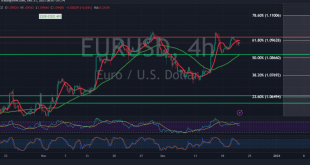

Read More »Euro is stable below resistance 21/12/2023

The recent trading session showcased predominant positive movements in the Euro/Dollar pair’s trajectory, as it endeavored to establish consolidation above the pivotal 1.0960 resistance level, achieving its peak at 1.0984. From a technical standpoint today, intraday dynamics demonstrate stability beneath the formidable 1.0960 mark, representing the robust resistance positioned at …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations