Oil, Crude, trading

Read More »CAD: positive scenario intact 17/1/2024

The Canadian dollar successfully reached the initial upward target in the preceding trading session, attaining the milestone at 1.3500 and marking its peak at 1.3502. Analyzing the 4-hour chart, we observe the simple moving averages persisting in guiding the price from below, concurrently with positive signals from the momentum indicator. …

Read More »USD/JPY achieve bullish targets 17/1/2024

japanese-yen

Read More »GBP Sterling achieves huge losses 17/1/2024

Oil, Crude, trading

Read More »Oil hits resistance 17/1/2024

Mixed trading characterizes the movements of US crude oil futures in the initial trading sessions of the week. After reaching its lowest point at $72.27, the price rebounded to retest the $72.50 level. Technically, a negative bias is evident, supported by the initiation of negative crossover signals from the simple …

Read More »Gold achieves the target and confirms breaking the support 17/1/2024

Gold prices experienced negative trading in line with the expected downward trajectory outlined in yesterday’s technical report, reaching the designated target at $2037 and marking a low at $2024 per ounce. Analyzing the 4-hour chart today reveals stability in trading below the support level of 2037, with gold still under …

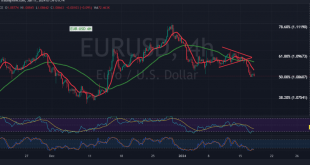

Read More »Euro touches the target and negativity persists 17/1/2024

The EUR/USD pair has conformed to the anticipated negative outlook outlined in the previous technical report, reaching the officially targeted level of 1.0865 and hitting a low at 1.0862. In terms of technical analysis today, examining the 240-minute time frame chart reveals continued pressure from the simple moving averages from …

Read More »Market Drivers – US Session, January 16, 2024

The US dollar was strongly supported by investors’ diminishing speculation about Fed interest rate cuts as US markets returned to a regular schedule. Meanwhile, the European currency was eventually affected by ECB officials’ continued disagreement with market perceptions regarding the timing of rate reductions. It is anticipated that Fedspeak, US …

Read More »GBP/USD declines after UK jobs data

The GBP/USD pair fell to a near-term low of 1.2620 in Tuesday trading, as broader markets shifted their focus from upbeat economic data to bidding up the US Dollar, sending the Pound Sterling into the new year’s lows. Broad-market bets of a rate cut from the Bank of England are …

Read More »US Dollar Has Touched Highest Level Since December

The DXY Index surged around 103.40, marking the highest level the US Dollar has been since mid-December. This was mostly caused by US traders coming back from vacation, which was further supported by a gradual increase in yields. Markets are pricing in another rate decrease in May as part of …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations