The Canadian dollar has validated the anticipated downward trajectory outlined in our previous technical analysis report, reaching the retest target of 1.3470 as forecasted, with a recorded low of 1.3474 during early morning trading. Technical Analysis: Bearish Bias Intact Assessing the technical landscape today, our analysis maintains a bearish stance, …

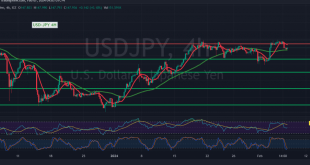

Read More »USD/JPY breaks support 7/2/2024

japanese-yen

Read More »GBP/USD Downtrend Persists, Targeting Key Support Levels 7/2/2024

Oil, Crude, trading

Read More »Oil touches the first target 7/2/2024

US Crude Oil Futures Surge, Meeting Expected Targets The anticipated upward trajectory in US crude oil futures contracts materialized as forecasted, with prices reaching and surpassing the initial target outlined in our previous technical analysis, touching $73.60 and soaring to a peak of $73.78 per barrel. Technical Analysis: Positive Signals …

Read More »Gold repeats bullish opportunities 7/2/2024

Gold Prices Display Limited Upside Amidst Technical Pressures Gold prices exhibited modest upward movements during the preceding trading session, albeit with constrained momentum. In our previous analysis, we maintained a stance of intraday neutrality, awaiting either a breakout above the 2016 resistance or confirmation of a breakout below the 2035 …

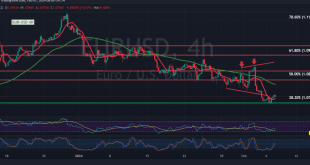

Read More »Euro is trying to establish support 7/2/2024

The EUR/USD pair has demonstrated resilience as it found solid support near the 1.0720 level, initiating today’s trading session with a commendable effort to rebound. Currently, the pair hovers around the critical resistance level of 1.0765, reflecting the market’s ongoing battle for direction. Technical Analysis: Mixed Signals Amidst Intriguing Dynamics …

Read More »Market Drivers – US Session, February 6

The US dollar’s correction caused the USD Index (DXY) to retreat from its previous annual highs, which were located at 104.60, in the face of similarly low US yields. On February 7, a number of Fed speakers, including Kugler, Collins, Barkin, and Bowman, will be speaking along with the Balance …

Read More »Gold seen firmer on softer US dollar as traders await Fed speakers

Following a decline in the US dollar and Treasury yields, gold saw a rise on Tuesday as traders braced themselves for statements from multiple Federal Reserve officials this week, which would likely provide insight into the rate of interest rate reductions this year.Gold Firmer on softer US Dollar As of …

Read More »EUR/USD flat despite positive European data

The EUR/USD is trading near previous lows as Euro bidders seek a foothold. European numbers came in better than predicted, but they still show a sluggish home European economy. The pair has little momentum as both the US dollar and the Euro fall. At the time of writing, the pair …

Read More »WTI surges amid output adjustment, softer dollar

The US crude oil benchmark, WTI, rose 0.87% to $73.51, driven by a weaker US Dollar and lower oil output forecasts. The Fed’s cautious interest rate outlook, with Loretta Mester highlighting a data-driven approach, has influenced market sentiment. The US Energy Department’s report lowering oil output and the Fed’s cautious …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations