Gold prices found stability on Thursday amidst a backdrop of nuanced market dynamics, influenced by statements from Federal Reserve officials tempering expectations of imminent interest rate cuts. Additionally, geopolitical tensions escalated following Israel’s rejection of a ceasefire proposal from Hamas, adding to the complex market landscape. Market Performance: Gold Settles …

Read More »CAD continues to decline 8/2/2024

In the wake of the preceding technical report, the Canadian dollar grappled with a prevailing downward trend, successfully reaching the initial target at 1.3470. Presently, trading activity hovers around its morning low, settling at 1.3450. Technical Analysis: Negative Momentum Signals Bearish Outlook Today’s technical analysis veers towards negativity, underscored by …

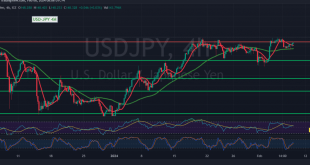

Read More »USD/JPY below resistance 8/2/2024

japanese-yen

Read More »GBP/USD Building on support 8/2/2024

Oil, Crude, trading

Read More »Oil touches the first target 8/2/2024

In the latest trading session, US crude oil futures contracts notched a significant milestone by hitting the initial target set at $74.00, culminating in a peak of $74.24 per barrel. Technical Analysis: Moving Averages and Relative Strength Index Signal Positivity A technical analysis reveals that simple moving averages are exerting …

Read More »Gold maintains the same technical conditions 8/2/2024

In the recent trading session, gold prices exhibited a pattern of short-term sideways movement with a bullish bias, aligning with previous technical analyses that highlighted the significance of surpassing the $2040 threshold. Notably, gold reached its pinnacle at $2044 per ounce, signaling upward momentum. Technical Insights: Balancing Negative Pressure with …

Read More »Euro continues to recover 8/2/2024

Euro/Dollar Pair Navigates Quiet Trading Session with a Positive Bias In the previous trading session, the Euro/Dollar pair demonstrated a subdued yet favorable trajectory, aligning with the anticipated bullish momentum. Notably, the Euro commenced its advance towards the critical 1.0780 resistance level, indicating a potential breakthrough on the horizon. Establishing …

Read More »Market Drivers – US Session, February 7

Riskier assets were able to gain additional momentum due to the continuing decline in the US dollar. As global rates continued to rise on Wednesday, investors now seem to support the Fed’s rate cut in May due to ongoing geopolitical concerns.Silver prices fell to fresh two-week lows around $22.20 per …

Read More »NYCB Explainer: Are current banking sector woes justified?

Over the last 24 hours, the stock of New York Community Bank (NYCB) has declined as a result of Moody’s downgrading the bank’s credit rating to junk status. After Signature Bank failed less than a year ago, NYCB acquired its assets and placed them under a new regulatory framework. NYCB …

Read More »AUD/USD trades sideways ahead of China’s PPI and CPI data

The AUD/USD pair is moving sideways near 0.6520 in the early Asian session, with Fed officials’ comments not significantly impacting the market. Future market traders expect the first rate cuts for the Reserve Bank of Australia to occur in September, rather than August. The pair consolidates above the 0.6500 psychological …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations