The Canadian dollar has exhibited the anticipated positive trajectory, achieving our initial target during the prior trading session, reaching a peak of 1.3529 against its counterpart. Technical Analysis Insights: Today’s technical analysis reveals the pair’s attempt to establish stability above the robust support level of 1.3500. Moreover, the Stochastic indicator …

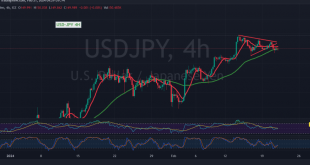

Read More »USD/JPY breaks support 21/2/2024

japanese-yen

Read More »GBP attacks the resistance 21/2/2024

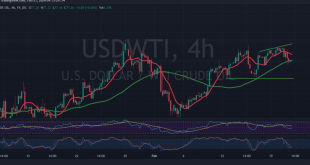

Oil, Crude, trading

Read More »Oil prices to be monitored 21/2/2024

US crude oil futures experienced a notable rally in the previous trading session, nearing the first upward target mentioned in the previous technical report at $78.70. However, the price faced resistance and retreated, reaching a peak of $78.50 per barrel before encountering downward pressure. Technical Analysis Overview Examining the technical …

Read More »Gold continues to advance, all eyes are on the Fed 21/2/2024

Yesterday, gold prices maintained their upward trajectory, aligning with the anticipated positive outlook. The precious metal touched the first target at $2027 and surged to reach a peak of $2031 during the early trading session today. Technical Analysis Perspective Analyzing the 240-minute time frame chart reveals that gold successfully retained …

Read More »Euro is trying to build an upward wave 21/2/2024

During the previous trading session, the Euro/Dollar pair witnessed predominantly positive trades, aligning with the anticipated bullish trajectory towards the official target of 1.0860. The pair reached its highest level at 1.0840, reflecting the strength of the upward movement. Technical Analysis Outlook From a technical standpoint today, examining the 4-hour …

Read More »Market Drivers – US Session, February 20

The US Dollar has weakened amid speculation that the Federal Reserve will delay the first rate cut. The odds for a 25 basis points (bps) March rate cut have decreased to 34.4%, while June ones have increased to 55.1%. Stock markets are tepid, with Wall Street spending most of the …

Read More »EUR/USD climbs ahead of FOMC minutes, Eurozone PMIs

Early on Tuesday, the EUR/USD pair moved above 1.0800 and tested the 1.0840 zone. A widespread sell-off of US dollars supports the Euro. Markets are awaiting EU PMIs and Fed meeting minutes.Tuesday saw the EUR/USD pair reach a two-week high just shy of 1.0840 as the dollar widely declined. However, …

Read More »USD/CAD bounces after Canadian CPI data

The USD/CAD pair experienced early declines before rebounding into an intraday high of 1.3530 after Canadian Consumer Price Index (CPI) inflation fell faster than expected. This softened the Canadian Dollar (CAD) across the board. Markets will focus on the Federal Reserve (Fed) and the Federal Open Market Committee (FOMC) as …

Read More »WTI crude oil settles lower amid global demand concerns

With worries about global demand outweighing price support from the Israel-Hamas conflict, oil prices settled down on Tuesday. While US West Texas Intermediate (WTI) crude for March delivery finished down $1.01, or 1.3%, at $78.18 a barrel, Brent futures settled down $1.22, or 1.5%, to $82.34 a barrel. At $77.04 …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations