Gold Surges on Weak Dollar and Middle East Tensions Gold prices surged on Thursday, bolstered by a weakened dollar and escalating tensions in the Middle East. Investors eagerly awaited more US economic data for insights into the Federal Reserve’s future interest rate decisions. At 0328 GMT, spot gold climbed 0.1 …

Read More »Gold Prices Rise Amid Dollar Weakness and Middle East Tensions

Gold prices climbed on Thursday, buoyed by a weakening dollar and escalating tensions in the Middle East. Investors remained attentive to upcoming US economic data, seeking insights into the Federal Reserve’s future interest rate policies. By 0328 GMT, spot gold advanced by 0.1 percent to $2,026.7 per ounce, following yesterday’s …

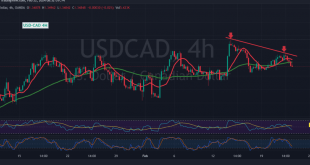

Read More »CAD Struggles Against Psychological Barrier 22/2/2024

The Canadian dollar faces hurdles in maintaining stability above the psychological resistance level of 1.3500, which serves as a formidable obstacle, constraining bullish momentum. Technical Analysis Insights In the current market landscape, a bearish trend unfolds below the critical 1.3500 threshold. A detailed analysis of the 4-hour timeframe chart reveals …

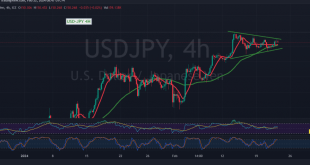

Read More »USD/JPY is waiting for a new signal 22/2/2024

japanese-yen

Read More »GBP Trying to Break Out of the Side Range 22/2/2024

Oil, Crude, trading

Read More »Oil Trying to Recover 22/2/2024

The landscape of US crude oil futures contracts witnessed a blend of movements, oscillating between upward and downward trajectories in yesterday’s trading session. Notably, a robust support level near $76.40 acted as a formidable barrier, curtailing downward pressure and steering prices to a close near the $78.00 mark. Technical Analysis …

Read More »Gold Remains Above Critical Support 22/2/2024

In a dynamic session of trading, gold prices experienced fluctuations, influenced by the strengthening of the US dollar following the Federal Reserve Committee’s announcements. Despite initial setbacks, gold surged to reach its peak at $2032 per ounce, showcasing resilience amidst market pressures. Technical Analysis Insights A comprehensive analysis of the …

Read More »Euro Continues Positive Momentum 22/2/2024

In the dynamic world of forex trading, the Euro/Dollar pair maintains its upward trajectory, demonstrating quiet yet positive trading sessions. During yesterday’s session, the pair reached its pinnacle at 1.0832, showcasing a bullish stance. Technical Analysis Insights Delving into the technical analysis realm today, a closer examination of the 4-hour …

Read More »Market Drivers – US Session, February 21

In the face of shifting risk appetite patterns and the FOMC Minutes’ lack of surprises, the dollar somewhat weakened on Wednesday. Meanwhile, speculation about when the Fed could cut interest rates for the first time continued to drive general market mood. In the context of continued increases in riskier assets, …

Read More »Us stocks enjoy late session rebound after Nvidia’s results

US stocks were able to erase previous losses ahead of Nvidia Corp.’s quarterly numbers, as investors eagerly awaited the firm’s ability to match the high expectations surrounding artificial-intelligence technology. Nvidia has been the poster child of AI enthusiasm, making semiconductor chips that power generative AI and demand for those chips …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations