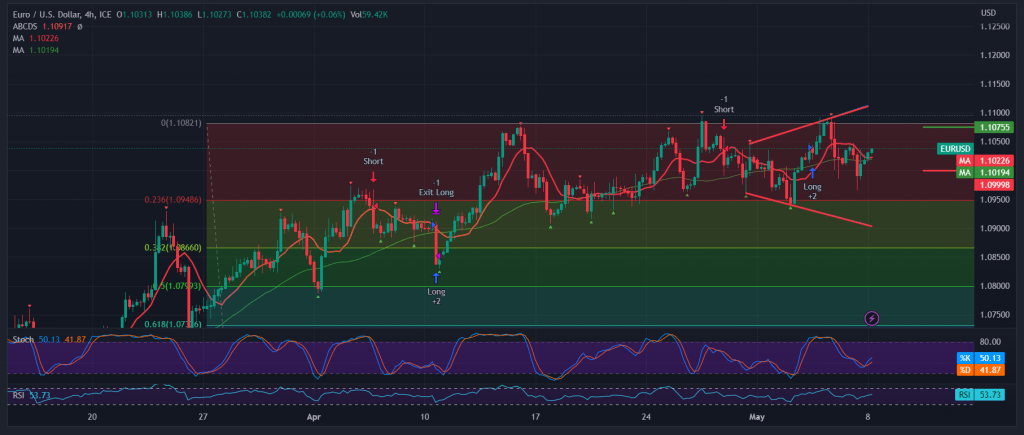

Mixed trading dominated the movements of the euro-dollar pair, within a downward sloping path, affected by the US data that appeared last Friday, recording its lowest level at 1.0970.

From a technical point of view, today, we find the pair’s intraday trading has returned to stability above 1.1000, accompanied by the pair obtaining a positive impulse from the simple moving average, which meets around 1.1000 and adds more strength to it, and on the other hand, we find negative signs coming from the stochastic on the 4-hour time frame.

Although we tend to be positive, we prefer to witness the breach of 1.1070, and that is considered the key to the return of the bullish trend, with targets of 1.1100 as the first target, and then 1.1150 as a next station, while the infiltration below 1.1000, and most importantly 1.0990, puts the pair under strong negative pressure, aiming to retest 1.0945, Fibonacci correction of 23.60%, before determining The general trend in the short term.

Note: Trading on CFDs involves risks. Therefore, all scenarios may be possible. This article is not a recommendation to buy or sell but rather an explanatory reading of the price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations