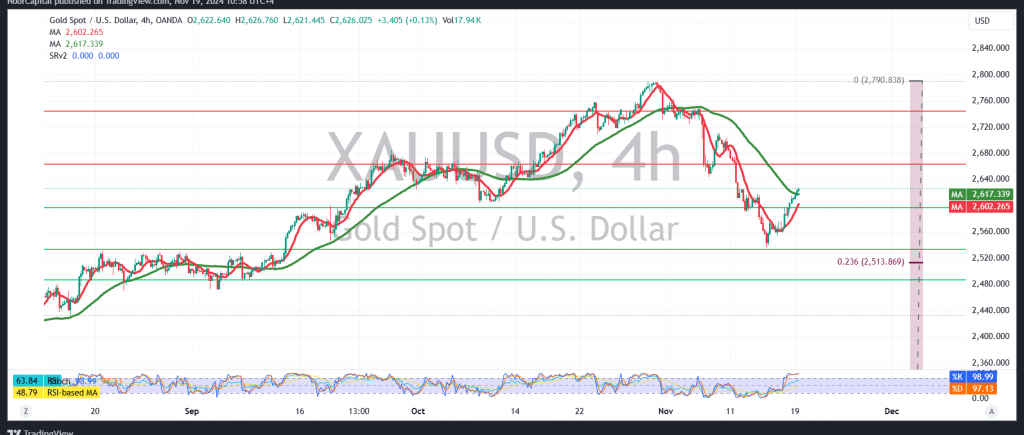

Gold prices showed strong upward momentum in the previous session, successfully building on the support level of 2567 and reversing the anticipated downward trend from the prior analysis. As highlighted earlier, surpassing 2604 was a significant catalyst, paving the way for a potential shift toward an upward trajectory, with prices reaching a peak of $2625 during the European trading session, offsetting prior selling pressures.

Technical Analysis Today:

We maintain a bullish outlook, supported by gold’s ability to stabilize above the 50-day simple moving average and to remain above the critical resistance level of 2600.

- Expected Movement: A continuation of the bullish trend could target 2643 as the first milestone. Breaching this level may strengthen the momentum, with 2660 as the next objective, and further gains could extend toward 2700.

- Risk of Downturn: If trading stabilizes below 2585, it may nullify the bullish scenario, reverting gold to a bearish trajectory. In this case, targets would be set at 2547 and 2527, with a potential decline toward the main target of 2513 if the support level breaks.

Warning: Trading gold carries high risks, particularly amid ongoing geopolitical uncertainties, which could lead to heightened price volatility.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations