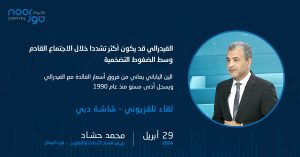

Mohammed Hashad, Head of Research and Development at Noor Capital and member of the US Association of Technical Analysts, commented and analyzed the most prominent market developments and the performance of the most important assets, in an interview on Dubai TV. US Interest Expectations, Federal Reserve Decisions:Asked about his expectations …

Read More »BoJ’s Ueda: Interest rate Policy in 2024 hinges on data

BoJ’s K. Ueda gave fresh statements on the central bank’s policy outlook, although he declined to comment on the recent performance of the Japanese yen.Before Thursday’s European session begins, the Japanese Yen was still weak relative to the US dollar and is trading barely above a multi-decade low that was …

Read More »Market Drivers – US Session, March 18

The US Dollar kicked off the week on a strong note, fueled by rising US Treasury yields and diminishing expectations of an interest rate cut by the Federal Reserve in June. This greenback surge weighed on riskier assets, pushing the Euro (EUR/USD) below 1.0900, a multi-day low.The Dollar Index (DXY) …

Read More »Anticipation Peaks Ahead of BoJ’s March Meeting: A Potential Policy Shift Looms

As the world watches, all eyes are on the Bank of Japan (BoJ) ahead of its March meeting scheduled for tomorrow, Tuesday. Market sentiment is rife with growing expectations that the BoJ might herald the end of negative interest rates, marking a significant departure from the prolonged era of quantitative …

Read More »Market Drivers – US Session, March 11

In the commodity market, WTI crude oil prices maintained their consolidative stance in the commodities market, circling the pivotal 200-day SMA and attempting to break through the $78.00 region. At $77.77 per barrel, US crude oil was last observed up 0.53%. Tuesday’s weekly update on US crude oil stocks as …

Read More »Market Drivers – US Session, February 8

Amid persistent rumours on a Fed interest rate cut in May, growing geopolitical concerns, and some comments implying that the ECB is not in a haste to start reducing rates, shifting trends in risk appetite ruled the mood across traded assets.In the midst of further repricing of an interest rate …

Read More »Market Drivers – US Session, Jan. 29

A second strong session for the US dollar placed more pressure on the riskier assets, pushing the EUR/USD to the sub-1.0800 level and the USD Index to flirt with the upper end of the current range amid the development of usual pre-FOMC caution.Ahead of the FOMC meeting and the release …

Read More »Market Drivers – US Session, Jan. 25

While Gold prices remained stuck in their current consolidative range, Silver prices rebounded further and clinched their third straight day of gains, this time flirting with the $23.00 mark per ounce.Firmer-than-expected US GDP figures have provided support to the US Dollar and further reinforced the already resilient stance of the …

Read More »Market Drivers – US Session, Jan. 24

A growing appetite for riskier assets caused gold prices to retreat during the North American session, closing in on the $2010 area. The recovery of interest in the risk complex put pressure on the dollar and drove the EUR/USD pair above 1.0900. News of further stimulus in China from the …

Read More »Bank of Japan expected to hold rates amid need for hints on inflation status

The central bank of Japan unlikely to make a move on Tuesday, when it is anticipated to see no changes to the Bank of Japan’s key monetary policy settings, with the major focus being on how Governor Kazuo Ueda evaluates the progress made in achieving the sustainable inflation required to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations