WTI erases early-week gains as it drops over 2% to trade at $62.20. In August, OPEC+ production increased by 509,000 barrels per day, reaching 42.4 million barrels per day. The IEA lowers its demand prediction to 740,000 bpd and warns of a 2.5 million bpd global surplus in H2 2025.As …

Read More »Oil Rally Seeks Confirmation 9/9/2025

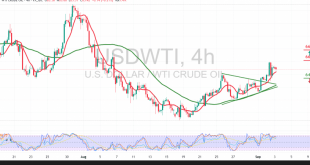

US crude oil futures (WTI) staged a cautious climb from the pivotal support at 61.60, with stability above this level reinforcing the intraday bullish wave. Technical Outlook – 4-hour timeframe: Holding above 61.60 strengthened the rebound and added positive momentum, as reflected by the Relative Strength Index (RSI), which has …

Read More »WTI Crude: Sustained Recovery or Return to Bearish Control? 8/9/2025

US crude oil futures (WTI) rebounded from the pivotal support at 61.60, with stability above this level reinforcing the intraday bullish wave. Technical Outlook – 4-hour timeframe: Holding above 61.60 provided the foundation for a solid rebound, with the Relative Strength Index (RSI) confirming renewed momentum after recovering from oversold …

Read More »Oil Breaks Through Key Resistance 3/09/2025

US crude oil futures extended their bullish momentum in line with the outlook from the previous report, climbing to a high near the psychological barrier of $66.00 per barrel. Technical Outlook – 4-hour timeframe: The price is moving within an upward corrective channel, supported by the breakout above the 65.00 …

Read More »Oil Defies Selling Pressure! 2/09/2025

US WTI crude oil futures recorded strong gains after successfully building a base above the psychological support at $63.00, climbing to a high of $65.05 per barrel. Technical Outlook – 4-hour timeframe: The price is trading within an upward corrective channel, supported by its stability above a well-defined ascending trend …

Read More »Oil’s Bullish Momentum Still Alive! 28/08/2025

US WTI crude oil successfully established a base above the psychological support at $63.00, as highlighted in the previous report, and staged an upward rebound that reached the official target at $64.20 per barrel—the highest level of the last trading session. Technical Outlook – 4-hour timeframe: Current intraday movements show …

Read More »WTI Crude Tests Crucial $63 Support Amid Mounting Pressure 27/08/2025

US WTI crude oil futures reversed the upward trend anticipated in the previous technical outlook, which had been based on trading above the 63.65 level, instead recording a low of $63.07 per barrel. Technical Outlook – 4-hour timeframe: The price is currently attempting to stabilize above the key psychological support …

Read More »Bullish Technical Indicators Support More Upside for Oil 26/08/2025

An uptrend has regained control of US WTI crude oil futures, with prices beginning to test the psychological resistance level at $65.00 per barrel. Technical Outlook – 4-hour timeframe: Intraday movements show a modest corrective bias following the previous session’s rise, yet upward rebound attempts remain active. The 50-period simple …

Read More »Oil: WTI Corrects Overbought Conditions 22/08/2025

Futures prices for West Texas Intermediate (WTI) crude oil temporarily regained their upward trend during the previous session after clearly breaking the resistance level of 62.50, reaching a high of $63.64 per barrel. Technical Outlook – 4-Hour Timeframe Intraday movements show a downward bias as part of a natural corrective …

Read More »Oil Succeeds in Overcoming Selling Pressure – 21/08/2025

Prices for US crude oil futures (WTI) regained their upward trend during the previous session after successfully breaking the 62.50 resistance level. This led to a high of $63.15 per barrel. Technical Outlook – 4-Hour Timeframe Current movements show continued attempts at an upward rebound. The 50-day Simple Moving Average …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations