U.S. WTI crude oil futures retreated after several consecutive sessions of gains, hitting a low near $61.30 per barrel during the previous session. Technical Overview The simple moving averages have turned into dynamic resistance levels, now exerting downward pressure on prices and likely limiting any recovery attempts. At the same …

Read More »Oil Regains Its Strength 8/10/2025

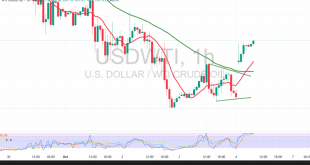

US WTI crude oil futures resumed an upward trajectory, attempting to recover losses from prior sessions after successfully establishing a solid support base near $60.80 per barrel. The move reflects renewed buying interest following a period of corrective pressure. Technical Outlook – 4-Hour Timeframe: The price is currently testing the …

Read More »Oil Holds Above Resistance 6/10/2025

US crude oil futures (WTI) started the week with a bullish price gap, reaching a high of $61.88 per barrel. Technical Outlook – 4-hour timeframe: The price is attempting to consolidate above the $61.50 resistance level, supported by positive signals from the Relative Strength Index (RSI), despite entering overbought territory. …

Read More »Oil Suffers Heavy Losses 3/10/2025

US crude oil futures faced heavy selling pressure in the last session, sliding to a low of $60.42 per barrel. Technical Outlook: Moving Averages: The simple moving averages continue to weigh on price from above, with the 50-day SMA converging near 61.80, reinforcing resistance. RSI: The index is in oversold …

Read More »Oil Strives to Recover Losses 1/10/2025

WTI crude oil successfully reached the downside target highlighted in the previous report at $62.20, recording a low of $62.00 per barrel. Technical Outlook: Moving Averages: Prices remain pressured from above, with dynamic resistance forming near $63.15, limiting recovery attempts. RSI: Hovering near oversold territory, the indicator is beginning to …

Read More »Selling pressure pushes oil down 30/9/2025

US crude oil futures (WTI) continue their decline, hitting a key resistance level around 65.30, which successfully limited the rise. Technical Outlook – 4-hour timeframe: Simple moving averages: Pressuring prices from above, forming dynamic resistance that limits any upward rebound. Relative Strength Index (RSI): Around oversold areas, with positive signs …

Read More »Heavy Selling Pressure Drags Oil Lower 23/9/2025

WTI crude extended its bearish trajectory, reaching the first target at $62.15 before recording a session low of $61.65, now approaching the next stop at $61.30. Technical Outlook: Simple Moving Averages (SMA): Prices remain under pressure from above, with moving averages forming dynamic resistance that limits rebound attempts. Relative Strength …

Read More »Oil Faces Mounting Bearish Pressure 22/9/2025

US crude oil futures opened with a bearish gap, touching a low of $62.44 per barrel during early trading. Technical Outlook: Simple Moving Averages (SMA): Pressuring the price from above, acting as dynamic resistance that may hinder recovery attempts. Relative Strength Index (RSI): Stabilizing below the 50 level, confirming the …

Read More »Oil Forms a Bullish Technical Pattern 17/9/2025

US crude futures extended their intraday bullish momentum, as anticipated, after breaching the $63.85 resistance, reaching the official target at $64.60 and printing a session high of $64.72 per barrel. Technical Outlook: Moving Averages: The simple moving averages continue to provide dynamic support from below, reinforcing the bullish bias. RSI: …

Read More »Oil Buyers Are Losing Steam 16/9/2025

US crude oil (WTI) futures advanced at the start of the week, reaching $63.63 per barrel, though the upward momentum still requires confirmation. Technical Outlook – 4-hour timeframe: The 50-period simple moving average continues to support prices from below, providing a solid base for the current move. However, early signs …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations