A bullish bias has re-emerged, with futures printing a $61.25 high. Technical outlook 50-SMA (4H): Price is holding above the moving average, keeping the uptrend intact despite a routine pullback on profit-taking. RSI: Attempting to turn higher, consistent with a resumption of upside momentum. Base case (bullish while above $59.90) …

Read More »Oil Tracks Along a Descending Trendline 7/11/2025

Futures are attempting to rebound after posting a $57.70 low, but the broader setup remains fragile. Technical outlook SMAs & structure: Simple moving averages sit overhead and a descending trendline persists—both acting as dynamic resistance and limiting upside. Base case (bearish while below $60.00) As long as price holds beneath …

Read More »Oil Holds Steady Above the Moving Average 4/11/2025

Price action has been mixed with a slight dip, but the corrective uptrend remains intact. Technical outlook SMAs: Still trending beneath price, supporting momentum. RSI: Attempting to turn higher, consistent with scope for another push up. Base case (bullish while above $60.45) Holding $60.45 keeps the upside favored. A decisive …

Read More »Oil Picks Up Extra Momentum 3/11/2025

US crude extended its climb toward the $61.75 objective flagged in the prior report, printing an early-session high at $61.41. Technical outlook SMAs: Simple moving averages are trending beneath price, supporting momentum. RSI: Stays constructive, consistent with ongoing upside pressure. Base case (bullish bias while above $60.75 / $60.30) Holding …

Read More »Oil Attempts to Shed Negativity 31/10/2025

Price action remains in a corrective uptrend, with buyers attempting to extend gains. Technical outlook: Simple moving averages sit beneath price and continue to offer support. RSI is constructive, helping sustain upside momentum. Base case (bullish bias while above 60.80): Holding 60.80 keeps the path higher toward 61.75, then 61.90 …

Read More »Oil Attempts to Carve Out a Bottom 28/10/2025

U.S. crude remains in a broader uptrend but is seeing near-term selling pressure after probing the $62.00 psychological barrier. Technical outlook SMAs (H4) continue to slope higher and sit beneath price, acting as dynamic support. RSI holds in constructive territory, consistent with base-building rather than trend reversal. Base case (favored)As …

Read More »Oil Faces Selling Pressure 20/10/2025

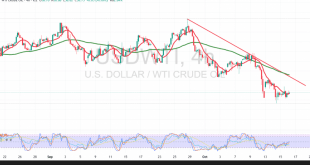

WTI crude futures extend their downtrend, with strong selling pressure driving prices to multi-month lows despite brief intraday rebounds. Technical (4H):Price action remains below a descending trend line, keeping bears in control. Down-sloping simple moving averages continue to act as dynamic resistance, capping recovery attempts and reinforcing the broader bearish …

Read More »Oil May Continue Its Downward Path 16/10/2025

WTI crude (U.S. futures) met the prior report’s target at $58.70, printing a low of $58.22 before a modest rebound. The move appears corrective within a broader bearish structure. Technical:Price remains capped beneath down-sloping simple moving averages, which act as dynamic resistance and may limit upside attempts. RSI is trying …

Read More »Oil: Downside Risks Still Persist 14/10/2025

U.S. crude oil futures attempted to recover a portion of their previous losses, reaching an intraday high of $60.14 per barrel during the prior trading session. However, the broader trend remains under pressure amid persistent bearish sentiment. Technical Overview The simple moving averages (SMAs) continue to weigh on price action …

Read More »Week Recap: Fed in a Bind Amid Stock Surge, Gold’s Record Gains

The recent trading week concluded amid a state of chaos dominated by sharp contradictions that swept through global markets and major institutions, forcing investors to reassess fundamental risks, redistribute capital, and rearrange their diversified asset portfolios.Amid government deadlock in Washington and an unprecedented escalation in the trade war between superpowers, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations