The Canadian dollar has resumed its intraday rise, attempting to recover losses from previous sessions after touching the 1.3722 level. From a technical analysis perspective today, and by closely examining the 4-hour chart, we find the pair hovering near the key resistance level of 13850. This resistance meets the 50-day …

Read More »Oil Prices Face Downward Pressure 28/5/2025

U.S. crude oil futures are trading with a negative bias, despite brief intraday attempts to stabilize. The price is currently hovering near $61.20 per barrel, reflecting continued selling pressure. From a technical perspective, oil prices remain below the 50-day simple moving average, which acts as a key dynamic resistance at …

Read More »Gold Attempts to Build Further Momentum 28/5/2025

Gold prices are currently trading within a narrow range, consolidating between $3,300 support and $3,350 resistance. This consolidation reflects a pause in momentum following recent gains, as the market awaits key catalysts. From a technical perspective, the underlying bullish trend remains intact. The Relative Strength Index (RSI) is showing signs …

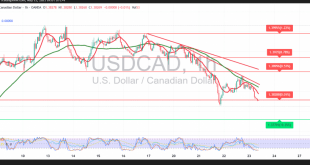

Read More »CAD Heads Toward Downside Targets 23/5/2025

As anticipated, the downtrend continues to dominate USD/CAD, following the pair’s failure to maintain stability above the psychological resistance at 1.3900. This rejection has led to renewed selling pressure and a shift to negative intraday momentum. From a technical perspective, the 4-hour chart reveals that 1.3900 remains a key resistance …

Read More »Oil May Extend Its Decline 23/5/2025

U.S. crude oil futures posted significant losses in line with the previously outlined bearish scenario, reaching the first official downside target at $60.45 and recording a session low of $60.27 per barrel. From a technical standpoint, oil prices are currently trading below the 50-day simple moving average, which is acting …

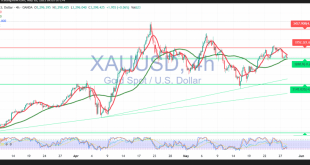

Read More »Gold Moves in Line with the Uptrend Line 23/5/2025

The key support level at $3,260, highlighted in the previous report, successfully limited the downside in gold prices during the prior session. Early European trading today has opened with a stable advance above the psychological $3,300 level, reinforcing the bullish structure. From a technical perspective, the uptrend remains intact. The …

Read More »CAD Faces Mild Downward Pressure 22/5/2025

The Canadian dollar came under renewed pressure in recent intraday trading after encountering strong psychological resistance at 1.3900, which triggered a downside reaction and negative momentum. On the 4-hour chart, the rejection from 1.3900 has been reinforced by the simple moving averages, which continue to act as dynamic resistance levels. …

Read More »Crude Oil Breaches Support Line 22/5/2025

U.S. crude oil futures experienced mixed trading in the previous session after testing the psychological resistance level at $64.00, which effectively halted the upward momentum and capped further gains. Technically, oil is now stabilizing around $61.60. A closer look at the 4-hour chart reveals that the price has broken below …

Read More »Gold Holds Firm to Its Uptrend 22/5/2025

Gold prices have surged in recent intraday trading, breaking decisively above the key $3,270 resistance level and reaching a new high of $3,345. From a technical analysis perspective, the bullish trend remains firmly in place. The Relative Strength Index (RSI) continues to gain upward momentum, holding above the 50 midline, …

Read More »CAD Needs a Positive Catalyst 16/5/2025

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base The Canadian dollar met its initial upside target at 1.4000, with the pair registering a session high of 1.4004 during the previous trading session. From a technical perspective, the 1.4000 psychological resistance level has exerted …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations