Trading tended to be negative and dominated the Canadian dollar’s movements, with the beginning of trading this week recording its lowest level yesterday at 1.3180. Technically, the current movements of the pair witness a limited bullish bias, benefiting from the attempt to stabilize above the support level of 1.3180, and …

Read More »Oil is still below resistance 20/6/2023

Mixed trading dominated the prices of US crude oil futures contracts yesterday, within a negative path, and the intraday oil movements are still stable below the resistance level of 71.55. Technically, the 50-day simple moving average pushes the price to the upside. On the other hand, negative features still dominate …

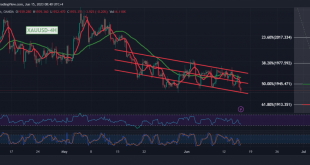

Read More »Gold needs confirmation 20/6/2023

Quiet, negative trading dominated gold prices during the first trading of this week amid the US market holiday after gold prices found it challenging to maintain the bullish path. Technically, today, we tend to be negative in our trading, relying on the stability of the price below the simple moving …

Read More »CAD loses momentum 15/6/2023

Trading tended to be negative, dominating the Canadian dollar’s movements within the expected bearish context, approaching by a few points away from the target to be achieved during the previous report at 1.3260, recording its lowest level at 1.3270. Technically, the current movements of the pair witness a limited bullish …

Read More »Oil hits resistance, negative pressure remains 15/6/2023

Crude oil futures prices declined significantly after failing to stabilize for a long time above the psychological barrier of $70.00, and the intraday movements are witnessing stability near its lowest level during the early trading of the current session, $97.95. Technically, with the continuation of moving below the simple moving …

Read More »Gold breaks support and breaks out of the sideways range 15/6/2023

For several consecutive sessions during the current week’s trading, we have committed ourselves to remain neutral due to the movements of gold prices in a confined sideways price range, from the bottom above 1945 and from the top below 1977, explaining that the activation of selling positions begins with a …

Read More »CAD: Canadian maintains negative stability 13/6/2023

The technical outlook is unchanged, and the Canadian dollar did not witness a significant technical change, maintaining the bearish context. The pair’s intraday movements are stable below the resistance level of 1.3390. Technically, the pair breached the support level at 1.3420 and turned into a resistance level according to reciprocating …

Read More »Oil is facing heavy selling 13/6/2023

US crude oil futures prices incurred significant losses during the last session’s trading within the expected downside trend. It touched the official target station at 67.80, recording its lowest level at $66.8 per barrel. Technically, by looking at the 240-minute chart, we find the continuation of the negative intersection of …

Read More »Gold Gold is uniform within the sideways trend 13/6/2023

Trading tended to negatively dominate the gold movements during the first trading sessions of this week. The sideways trend is still active and active, so the technical outlook remains unchanged. Over several consecutive sessions, we waited for the pending orders to be activated due to the sideways movements that dominated …

Read More »CAD: Negativity remains 12/6/2023

Positive movements dominated the trading of the British pound against the US dollar within the expected bullish context by last week’s trading, touching the first target 1.2595, recording its highest level at 1.2593. On the technical side today, and by looking at the 4-hour chart, we find that the simple …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations