U.S. crude oil futures experienced notable fluctuations during yesterday’s trading session, primarily due to profit-taking following the sharp rally that began late last week. From a technical perspective, oil prices are attempting to establish a solid support base around the psychological level of $69.00 in order to resume the upward …

Read More »Gold Tries to Restore Upward Momentum 17/6/2025

Gold experienced a downward trend during yesterday’s session, moving within a weak and somewhat indecisive pattern that deviated from the anticipated bullish outlook. Despite this, the price remained above the key support level of $3,390, recording a session low at $3,373 per ounce. From a technical standpoint, today’s outlook remains …

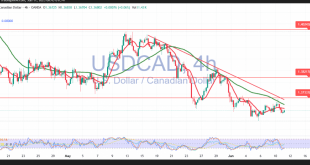

Read More »CAD Tries to Recover Some of Its Losses 16/6/2025

Limited bullish attempts have emerged in the short term, attempting to stabilize the USD/CAD pair after the 1.3570 support level temporarily halted the prevailing downtrend. From a technical standpoint, the 4-hour chart reveals persistent bearish pressure, with the simple moving averages capping gains from above. Additionally, the Relative Strength Index …

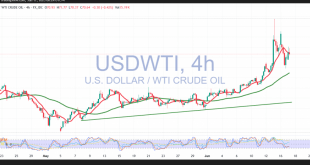

Read More »Oil May See a Relief from Overbought Conditions 16/6/2025

US crude oil futures posted their largest gains since March 2022, surging to a high of $77.57 per barrel as geopolitical tensions escalated, fueling fears of supply disruptions and boosting safe-haven flows into commodities. From a technical standpoint, despite the profit-taking-driven intraday pullback, the overall trend remains decisively bullish. Overbought …

Read More »Gold Undergoes Overbought Correction 16/6/2025

Gold prices surged significantly, propelled by intensifying geopolitical tensions, surpassing the official target of $3,416 mentioned in the previous technical report and reaching a new all-time high of $3,451 per ounce. Technically, while the Relative Strength Index (RSI) indicates overbought conditions, which could suggest a temporary slowdown, the broader trend …

Read More »CAD Continues to Slide Further 12/6/2025

The Canadian dollar continued its decline against the U.S. dollar within the expected bearish trend, reaching the first target of 1.3650 outlined in the previous technical report, with the pair recording a session low of 1.3648. From a technical standpoint, the 4-hour chart confirms the persistence of downside pressure. The …

Read More »Oil May Undergo Overbought Correction 12/6/2025

U.S. crude oil futures posted sharp gains in the previous session, reaching the official target of $66.85 and extending to a session high of $68.98 per barrel. From a technical standpoint, intraday price action showed signs of bearish pressure, largely attributed to profit-taking after the strong rally. This coincides with …

Read More »Gold Attempts to Regain Its Uptrend 12/6/2025

Gold prices exhibited mixed behavior during recent sessions, initially continuing the expected corrective decline and approaching the first downside target of $3,312, as highlighted in the previous technical report. The metal recorded a low of $3,315 before reversing course, driven by a sharp rebound following the release of U.S. inflation …

Read More »CAD Maintains Its Bearish Trend 11/6/2025

The technical outlook remains unchanged, with no significant shift in the pair’s behavior. The prevailing downtrend continues to dominate, reflecting persistent bearish sentiment. A closer look at the 4-hour chart shows that the simple moving averages continue to apply downward pressure on price action. This is reinforced by the Relative …

Read More »Oil May Extend Its Gains 11/6/2025

U.S. crude oil futures followed the expected bullish trajectory, successfully reaching the first official target at $65.90 and coming within reach of the second target at $66.45, with a session high recorded at $66.24 per barrel. From a technical standpoint, the psychological resistance near $65.00 continues to exert downward pressure …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations