The USD/CAD pair recorded modest gains during today’s session as it attempted to recover from recent losses, showing cautious bullish momentum in intraday trading. Technical Outlook – 4-hour Chart:Despite the slight rebound, the pair remains under pressure from the simple moving averages acting as dynamic resistance. Additionally, the Relative Strength …

Read More »Oil Prices Under Pressure — Are Further Losses Ahead? 2/7/2025

Oil prices traded cautiously higher during today’s session, following a string of consecutive declines. The market saw a modest rebound, with prices testing the psychological resistance level at $66.00 per barrel. Current Range: Support: $64.65 Resistance: $65.95 Prices remain confined within a narrow sideways range. The simple moving averages continue …

Read More »Strong Buying Momentum Puts Gold Back in the Spotlight 2/7/2025

Gold prices saw a strong rebound in the previous session, achieving a short-term upward correction within a broader downtrend, reaching the anticipated technical targets of $3327 and $3360, with a session high at $3358 per ounce. Technical Outlook (4-hour chart):The $3358 resistance level has proven to be a firm barrier, …

Read More »CAD Struggles to Maintain Upbeat Momentum in a Cautious Market 26/6/2025

The USD/CAD pair exhibited cautious bullish behavior yesterday, aligning with the expected upward scenario and reaching a high near the key resistance level of 1.3760. From a technical standpoint today, the 240-minute chart reveals continued support from the simple moving averages, which are reinforcing the bullish sentiment. Additionally, the Relative …

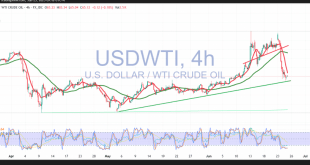

Read More »Crude Faces Heavy Selling — Where Could It Go from Here? 26/6/2025

US crude oil futures experienced narrow-range trading, showing only a slight upward inclination and reaching a high of $66 per barrel. From a technical perspective, oil prices are attempting to recover some of the recent losses during intraday movement, with current efforts focused on stabilizing above the $65.00 level. However, …

Read More »Controlled Rebound: Gold Rises Amid a Bearish Backdrop 26/6/2025

Gold prices showed limited movement during the previous trading session but opened the early hours with a cautious rise after approaching oversold levels, recording a high of $3,343. From a technical standpoint, gold appears to be attempting to recover some of its earlier losses. Intraday charts suggest a modest upward …

Read More »CAD Holds on to Its Bullish Sentiment 25/6/2025

The USD/CAD pair received a positive boost during the previous trading session, successfully recording its highest level near the 1.3740 resistance level. From a technical analysis perspective today, and by examining the 240-minute chart, we find that the simple moving averages are still supporting the price from above, providing positive …

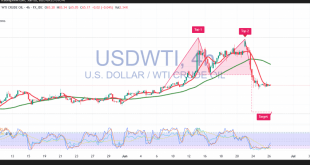

Read More »Oil in Retreat, Heavy Selling Triggers Sharp Drop 25/6/2025

U.S. crude oil futures experienced a sharp drop yesterday, testing the psychological support level around $64.00 per barrel. From a technical perspective, intraday price action shows a modest recovery, with prices currently trading slightly above $65.00. A review of the 4‑hour chart indicates that the simple moving averages remain positioned …

Read More »Gold Lacks Conviction Amid Uncertain Direction 25/6/2025

Gold prices took a sharp downturn during the previous session, hitting a low of $3,295 per ounce. From a technical standpoint, the market is attempting a modest rebound following oversold conditions. However, the 60-minute chart shows the price is still contained within a downward corrective wave, bounded by a descending …

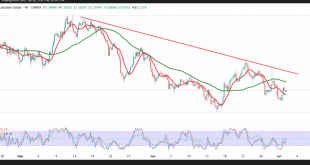

Read More »CAD Holds Steady Within the Bearish Trend 17/6/2025

The technical outlook remains unchanged for the USD/CAD pair, with price movements still dominated by a bearish trend after encountering strong resistance near the psychological level of 1.3600. From today’s technical analysis perspective, the 4-hour chart shows that the simple moving averages continue to apply downward pressure from above. Additionally, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations