Gold prices experienced narrow-range sideways movement yesterday, maintaining the existing technical outlook. The price of gold remains confined above 1977 from the bottom and below 1993 from the top. Upon examining the 240-minute timeframe chart, it is evident that the price has remained stable below the 1992 resistance level. Additionally, …

Read More »CAD presses support 2/11/2023

Mixed trading characterized the movements of the Canadian dollar, managing to reach the initial upward target at 1.3900 in today’s trading session. From a technical perspective, the psychological barrier resistance at 1.3900 created negative pressure, leading the pair to retest the support level at 1.3830, where it stabilized. Upon closer …

Read More »Oil: Negative pressure remains 2/11/2023

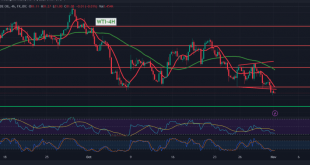

During the previous trading session, US crude oil futures exhibited mixed movements amid varied trading patterns. The prices briefly touched the stop losses mentioned in the previous report at $82.70, reaching a peak at $83.40. However, this level acted as a robust resistance, prompting a decline and causing oil to …

Read More »Gold requires careful consideration 2/11/2023

The formidable resistance level identified in the previous analysis at $1991 exerted significant downward pressure on gold prices, causing it to trade negatively and ultimately break the $1977 mark. Gold came within a few points of reaching the initial target of $1967, reaching its lowest point at $1969 per ounce. …

Read More »CAD achieves the first goal 1/11/2023

During the previous trading session, the Canadian dollar successfully reached the initial target set at 1.3875, reaching its highest point at 1.3892. From a technical perspective, our analysis leans toward optimism. The 50-day simple moving average continues to support the potential for an upward movement. Additionally, intraday trading stability above …

Read More »Oil continues to suffer losses 1/11/2023

US crude oil futures prices have sustained losses as anticipated in the previous report, reaching the initial target of $81.15 and touching a low of $80.80 per barrel. Upon analysis of the 240-minute timeframe, the trading remains stable below $82.00 and, more broadly, under the resistance level of $82.70. This …

Read More »Gold: Has the downward correction begun? 1/11/2023

Gold prices followed the pattern outlined in the last technical report, successfully retesting the officially designated target at $1977. Today’s session began with continued pressure on this level. Upon a detailed analysis of the 240-minute timeframe chart, it’s evident that the simple moving averages are exerting downward pressure on the …

Read More »CAD stable above support 31/10/2023

The previously mentioned support level at 1.3815 successfully contained the bearish momentum that emerged at the start of the last trading session. From a technical perspective, the trend is leaning towards positivity. The 50-day simple moving average continues to support the potential for an upward movement. Intraday trading maintains stability …

Read More »Oil confirms breach 31/10/2023

In the previous technical report, we maintained an intraday neutral stance for the US crude oil futures contract due to conflicting technical signals. The price movements indicated a downward trend, highlighting the necessity of a clear and robust breach of the 83.80 level to activate selling positions. The target after …

Read More »Gold may retest support 31/10/2023

Gold prices experienced subdued trading, predominantly following a slight downward trajectory, reaching its lowest point at $1,990 per ounce in the initial trading sessions of the week. From a technical perspective, today saw gold prices exerting downward pressure, particularly around the $1,995 mark. Additionally, both the Stochastic indicator and the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations