Yesterday, positive movements dominated US crude oil futures contracts, aligning with the anticipated bullish context and reaching a peak at $78.11 per barrel. From a technical perspective, the upward momentum faced resistance at the psychological barrier of $78.00, leading to a temporary downward bias. A closer examination reveals that the …

Read More »Gold touches targets, eyes are on the Fed 31/1/2024

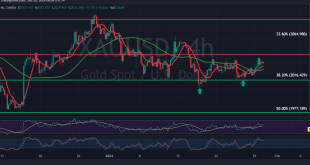

In the previous trading session, gold exhibited a strong upward trend, meeting the initial targets outlined in the preceding technical report at $2040 and $2048, reaching its highest level at $2048 per ounce. From a technical standpoint, the $2048 level exerted negative pressure on the price, prompting a retest of …

Read More »CAD continues to decline 30/1/2024

Limited positive attempts dominated the movements of the Canadian dollar temporarily, hitting the resistance level of 1.3535, which succeeded in limiting the upward tendency. From a technical analysis standpoint, today prices are witnessing stability below the psychological barrier resistance level of 1.3500, and with a closer look at the 4-hour …

Read More »Oil is making notable gains 30/1/2024

US crude oil futures exhibited significant gains in the previous session, in line with expectations, reaching the officially targeted station outlined in the preceding technical report at $77.30 and marking a peak at $77.46 per barrel. A technical analysis on the 4-hour timeframe chart reveals the continued influence of simple …

Read More »Gold establishes a support floor 30/1/2024

Gold experienced positive trading during the initial sessions of the week, breaking free from a recent period of sideways movement. The precious metal established a robust support level around the 2016 mark. From a technical perspective today, the outlook tends towards optimism, relying on the stability of trading above the …

Read More »CAD facing negative pressure 26/1/2024

Limited positive attempts dominated the movements of the Canadian dollar temporarily, hitting the resistance level of 1.3535, which succeeded in limiting the upward tendency. From a technical analysis standpoint, today prices are witnessing stability below the psychological barrier resistance level of 1.3500, and with a closer look at the 4-hour …

Read More »Oil is making notable gains 26/1/2024

US crude oil futures exhibited significant gains in the previous session, in line with expectations, reaching the officially targeted station outlined in the preceding technical report at $77.30 and marking a peak at $77.46 per barrel. A technical analysis on the 4-hour timeframe chart reveals the continued influence of simple …

Read More »Gold is still in a sideways price range 26/1/2024

Gold prices demonstrated limited movements in the previous trading session, characterized by a prevailing downward trend. As highlighted earlier, breaching the 2016 level aims for a touchpoint at 2005, potentially reaching its lowest level at $2009 per ounce. From a technical standpoint, the price has returned to stability above the …

Read More »CAD attacks the resistance 25/1/2024

The Canadian dollar displayed notable gains in the wake of the Central Bank of Canada’s decision, defying the previously anticipated negative outlook that was contingent on maintaining stability below the psychological resistance barrier of 1.3500. From a technical analysis perspective today, intraday movements of the pair are holding steady above …

Read More »Oil touches the required targets 25/1/2024

US crude oil futures prices have surged as anticipated, reaching the designated target in the previous trading session at $75.20 and coming within a few points of the subsequent target at $76.00. The recorded peak stands at $75.80 per barrel. From a technical perspective, oil prices are holding steady above …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations