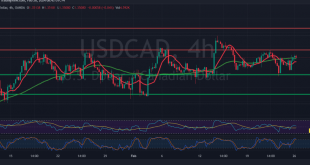

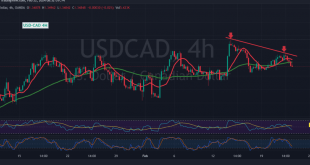

The Canadian dollar pair commenced its weekly trading session on a bullish note, albeit with some limitations, following its successful retest of the robust support level at 1.3460. In terms of technical analysis today, we lean towards a positive outlook, supported by the pair’s stability in trading above the aforementioned …

Read More »Oil facing strong resistance 26/2/2024

US crude oil futures prices faced significant downward pressure towards the end of last week’s trading, failing to maintain stability above the crucial psychological barrier at $78.00. This development negated the anticipated positive outlook. In the previous technical report, we highlighted that breaching the support level at $77.35 would nullify …

Read More »Gold successfully tests support 26/2/2024

Gold prices surged, buoyed by the support level highlighted in the previous technical report at the price of 2016. This support level played a pivotal role in driving prices upward, aligning with our positive outlook. The market witnessed the attainment of initial official targets, reaching as high as 2042.00. Analyzing …

Read More »CAD: Negative pressure exists 23/2/2024

Negative trading prevailed in the movements of the Canadian dollar during the previous trading session, aligning with the anticipated negative outlook. The pair touched the first target at 1.3465 and came close, within a few points, to reaching the second target at 1.3420, marking its lowest point at 1.3440. From …

Read More »Oil is recovering 23/2/2024

The US crude oil futures contracts have continued their upward trajectory, in line with the bullish forecast outlined in the previous technical report, reaching the initial target at $78.60 and peaking at $78.88 per barrel. From a technical standpoint, the prevailing sentiment remains positive, supported by the ongoing influence of …

Read More »Gold is holding above support 23/2/2024

Gold prices have reached the initial technical target at $2035 per ounce, marking its highest level in the previous trading session. Upon examining the 4-hour timeframe chart from a technical perspective, it’s observed that the $2035 level has acted as a barrier to further upward movement in gold prices. However, …

Read More »CAD Struggles Against Psychological Barrier 22/2/2024

The Canadian dollar faces hurdles in maintaining stability above the psychological resistance level of 1.3500, which serves as a formidable obstacle, constraining bullish momentum. Technical Analysis Insights In the current market landscape, a bearish trend unfolds below the critical 1.3500 threshold. A detailed analysis of the 4-hour timeframe chart reveals …

Read More »Oil Trying to Recover 22/2/2024

The landscape of US crude oil futures contracts witnessed a blend of movements, oscillating between upward and downward trajectories in yesterday’s trading session. Notably, a robust support level near $76.40 acted as a formidable barrier, curtailing downward pressure and steering prices to a close near the $78.00 mark. Technical Analysis …

Read More »Gold Remains Above Critical Support 22/2/2024

In a dynamic session of trading, gold prices experienced fluctuations, influenced by the strengthening of the US dollar following the Federal Reserve Committee’s announcements. Despite initial setbacks, gold surged to reach its peak at $2032 per ounce, showcasing resilience amidst market pressures. Technical Analysis Insights A comprehensive analysis of the …

Read More »CAD trying to gain additional momentum 21/2/2024

The Canadian dollar has exhibited the anticipated positive trajectory, achieving our initial target during the prior trading session, reaching a peak of 1.3529 against its counterpart. Technical Analysis Insights: Today’s technical analysis reveals the pair’s attempt to establish stability above the robust support level of 1.3500. Moreover, the Stochastic indicator …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations