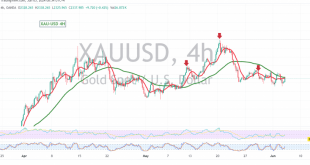

Gold prices experienced mixed trading in the previous session, influenced by the Federal Reserve’s interest rate decision. On the 4-hour chart, the key resistance level of 2340, as previously highlighted, successfully capped the upward movement. Gold’s inability to breach this level, combined with the persistent negative pressure from simple moving …

Read More »USD/CAD Technical Analysis: Uptrend Continuation Expected 11/6/2024

The USD/CAD pair maintains its upward trajectory, holding firm above the key support level of 1.3690. This stability has propelled the pair to rebound upwards, reaching 1.3780. Technical analysis suggests a continuation of the uptrend. Positive momentum from the simple moving averages, coupled with the Stochastic oscillator’s attempts to gain …

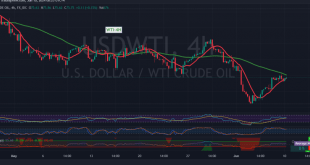

Read More »WTI Crude Oil Technical Analysis: Potential Shift to Bullish Trend 11/6/2024

WTI crude oil prices rebounded during the previous session, finding support at the pivotal 75.25 level we highlighted in our prior report. A break below this level would have signaled a continuation of the downward trend. On the 240-minute chart, we now observe positive crossover signals from the simple moving …

Read More »Gold Technical Analysis: Corrective Decline Expected to Continue 11/6/2024

Gold’s price movement remains aligned with our previous technical assessment, continuing its downward corrective path, reaching a low of $2287.00 per ounce. On the 4-hour chart, we observe a clear break below the previously breached support level of 2318.00. This, coupled with negative pressure from the simple moving averages and …

Read More »Canadian Dollar Soars, Bullish Momentum Builds 10/6/2024

The Canadian dollar (CAD) experienced a significant surge at the end of last week, breaking through the 1.3720 resistance level and reaching an intraday high of 1.3773. The current technical outlook suggests a continuation of the bullish trend. Positive signals from the simple moving averages and the 14-day momentum indicator …

Read More »Oil loses momentum 10/6/2024

WTI crude oil futures experienced mixed trading, attempting to bounce back from recent lows by utilizing the 75.25 support level. Currently trading at $75.75 per barrel, the commodity faces a bearish outlook due to several technical factors. The 50-day simple moving average continues to act as a strong resistance barrier, …

Read More »Gold returns to the downward correction 10/6/2024

Gold prices experienced a sharp decline, surrendering recent gains due to a strengthening U.S. dollar following the release of strong U.S. jobs data last Friday. The precious metal, which previously struggled to break above the 2360 resistance level, has now fallen below the crucial 2318 support, reaching a low of …

Read More »CAD stable below resistance 5/6/2024

The Canadian dollar (CAD) witnessed positive trading in the previous session, but its upward momentum was curtailed by the pivotal resistance level of 1.3690. Technical indicators now suggest a potential shift towards a bearish trend. The Stochastic oscillator on the 240-minute timeframe is showing signs of waning upward momentum, indicating …

Read More »Gold is looking for a stronger direction 5/6/2024

The technical landscape for gold remains largely unchanged, with the precious metal holding above the 2318 support level but facing resistance from the 50-day simple moving average. Despite yesterday’s upward movement, the 50-day simple moving average continues to exert downward pressure on the price. Additionally, the Stochastic oscillator is showing …

Read More »CAD may witness a negative session 4/6/2024

The Canadian dollar experienced a subdued trading session yesterday, characterized by narrow fluctuations within a broader bearish trend. The currency pair reached a low of 1.3603 against the US dollar. Technical analysis suggests a continuation of this downward momentum. The Stochastic oscillator on the 240-minute timeframe is showing signs of …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations