WTI crude oil futures prices exhibited strong bullish momentum yesterday, successfully reaching our initial target of 81.50 and achieving a peak of $81.50 per barrel. Technical Outlook: The technical outlook remains bullish, with the 240-minute chart showing that simple moving averages (SMAs) are providing continuous support for the ongoing upward …

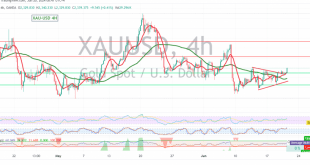

Read More »Gold: Bullish Momentum Emerges After Downward Trend 21/6/2024

Gold prices reversed their previous downward trend and rallied during yesterday’s trading session, surpassing the key resistance level of 2340 and reaching a high of $2365 per ounce. This price action indicates a potential shift in sentiment towards a bullish outlook. Technical Outlook: The technical analysis now suggests a continuation …

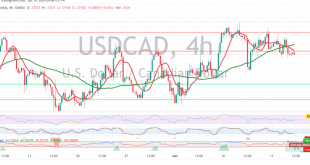

Read More »USD/CAD: Bullish Potential Amidst Positive Signals 20/6/2024

The USD/CAD pair has successfully held above the crucial 1.3690 support level, indicating a potential shift towards a bullish bias. Technical Outlook On the 4-hour chart, the Stochastic oscillator is showing positive crossover signals, suggesting a potential increase in upward momentum. Additionally, the Relative Strength Index (RSI) is attempting to …

Read More »WTI: Cautious Bullish Outlook Amidst Upward Momentum 20/6/2024

WTI crude oil futures prices continue their upward trajectory, approaching our previously identified target of 81.30 and reaching a high of $81.13 per barrel. Technical Outlook: While the intraday movement shows some consolidation below 81.00, the overall trend remains bullish. The Stochastic indicator on the 4-hour chart is hinting at …

Read More »Gold: Bearish Bias Prevails Despite Positive Opening 20/6/2024

Gold prices opened on a positive note today, retesting the pivotal resistance level of 2340. However, the technical outlook remains predominantly bearish. Technical Analysis On the 240-minute chart, while the simple moving averages are now providing support from below, suggesting a potential upward trend, the price remains below the crucial …

Read More »USD/CAD: Bearish Bias Dominates Amid Downward Pressure 19/6/2024

The USD/CAD pair is experiencing a downward trend, primarily due to the collision with the 1.3760 resistance level, which has capped recent gains and limited the upward momentum. Technical Outlook: Technical analysis suggests a prevailing bearish bias. This is supported by the negative crossover of the simple moving averages, which …

Read More »WTI: Bullish Momentum Strengthens, Eyes on $80 19/6/2024

WTI crude oil futures prices are on the rise, targeting the $80.00 per barrel threshold. Technical Outlook: Our analysis remains bullish, bolstered by the price finding support above the critical 79.65 level and the continued positive momentum provided by the simple moving averages. Upward Potential: The upward trend appears poised …

Read More »Gold: Bearish Flag Formation Suggests Further Downside 19/6/2024

Gold prices remain confined within a narrow sideways range, bounded by the 2313 support level and the 2340 resistance level. Technical Outlook: Analysis of the 240-minute chart reveals a bearish flag pattern formation, indicating a potential continuation of the downward trend. The 50-day simple moving average is exerting negative pressure, …

Read More »USD/CAD Technical Analysis: Uptrend Continuation Expected Amidst Positive Momentum 13/6/2024

The USD/CAD pair continues to exhibit a strong upward trend, bolstered by its firm footing above the crucial support level of 1.3690. Technical Outlook Our technical analysis suggests a continuation of the uptrend. The positive momentum derived from the simple moving averages, coupled with the Relative Strength Index’s (RSI) attempts …

Read More »WTI Crude Oil Technical Analysis: Cautious Bullish Outlook Amidst Potential Gains 13/6/2024

WTI crude oil futures prices experienced notable gains yesterday, reaching our previously identified target of 78.80 and peaking at $79.28 per barrel. Technical Outlook We maintain a cautiously bullish outlook, supported by the positive influence of the 50-day simple moving average and the price holding above the crucial 77.60 support …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations