We committed to the intraday neutrality during the previous analysis due to the contradictory technical signals, to find that gold prices witnessed positive moves, negating the bearish tendency to reach its highest level during the Asian session at 1858. On the technical side, and with a closer look at the …

Read More »Germany’s DAX Starts Positively

The German DAX Index opened its daily trading with clear negativity after finding a strong resistance level around 13,290. Technically speaking, we tend to be negative, depending on the stability of trading below the mentioned level, in addition to the continuation of negative pressure from the simple moving averages. In …

Read More »Dow Jones Faces Temporary Negative Pressure

Mixed trades dominated the movements of the Dow Jones Industrial Average during the previous trading session, approaching the required target located at 30,360, posting a high of 30,320. On the technical side, the current movements are witnessing a bearish bias on short time frames due to the negative signs coming …

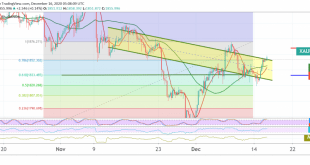

Read More »CAD Trying to Build on Support

Positive attempts for the Canadian dollar, taking advantage of building a base on the psychological barrier support 1.2700, trying to re-test the resistance level of 1.280 Technically, stability above 1.2720 supports the possibility of the upside, and with a closer look at the chart, we find the RSI indicator started …

Read More »Gold Still Confused And Negativity Persists

Gold prices succeeded in achieving the negative outlook, as we expected, in which we relied on trading below the 1833 level, heading to visit the first target to be achieved, 1818, recording its lowest level at 1818.60. On the technical side, the current movements of gold are witnessing attempts to …

Read More »Germany’s DAX Starts Positively

The German DAX index began its weekly trading with a bullish tendency, recording its highest level during early trading for the current session 13,277. On the technical side, we tend to be positive in our trading, relying on the index’s anchorage above the 13,000 support floor accompanied by the positive …

Read More »Dow Jones Making Strong Gains

The Dow Jones Industrial Average jumped at the beginning of this week’s trading within a bullish path, as we expected a gradual approach to the required target 30,270, recording its highest level during early trading for the current session 30,213. On the technical side, with the RSI indicator continuing to …

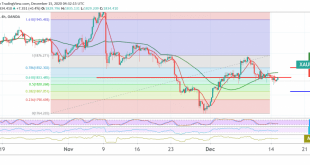

Read More »CAD: Negative Pressure Remains

Limited positive attempts dominated the Canadian dollar’s movements after it hit the first official target indicated during the last analysis, located at 1.2700. From the angle of technical analysis today, we find that the stochastic gradually started losing the bullish momentum, and we find the simple moving averages continuing their …

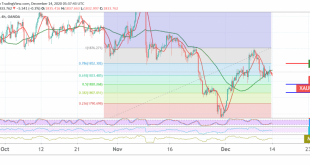

Read More »Gold Attacks Support

Trading tended to be negative during the last trading session last week, when gold prices touched the first target to be achieved, 1825, recording its lowest level at 1823. Technically, despite the return of stability above the support floor of 1823, we find negative signs still dominating the stochastic, accompanied …

Read More »German Dax Maintains Positive Stability

The German DAX maintains positive stability after succeeding in establishing a decent support floor above 13,220 and generally above 13,190. On the technical side, we tend to be positive in our trading, relying on the index’s anchorage above the 13,220 support floor, which is accompanied by the positive stimulus of …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations