Negative pressure dominated US crude oil futures prices during last Wednesday’s trading, erasing recent gains and reaching a low of $69.28 per barrel. From a technical perspective, the outlook remains cautiously negative, influenced by the bearish crossover of the simple moving averages, which are exerting downward pressure on the price. …

Read More »Gold may get more positive signals 26/9/2024

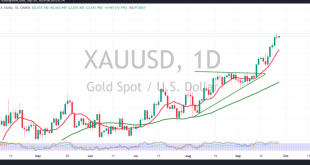

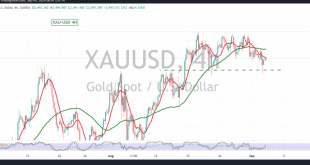

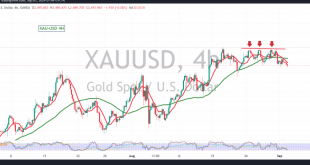

Gold prices continued to reach record highs for the fourth consecutive session, hitting a new peak during the previous trading session at $2,671.00 per ounce. From a technical analysis perspective today, and looking at the 4-hour chart, gold displayed some bearish bias, retesting the previously breached resistance near $2,650. The …

Read More »Financial Markets’ Weekly Recap: Fed’s rate cut size in focus

US dollar has ceased its upward trajectory since the release of US economic data indicating a slowdown in consumer prices. This data has reinforced expectations that the Federal Reserve is likely begin cutting interest rates at its September meeting. This data has fuelled speculation that the Federal Reserve is likely …

Read More »A negative oil scenario may occur 5/9/2024

US crude oil futures extended their losses during the European trading session, reaching the first official target of $69.00 and recording a low of $68.85 per barrel. From a technical perspective, oil found solid support near $69.00, leading to some temporary gains. However, a closer look at the 4-hour chart …

Read More »Gold needs extra momentum 5/9/2024

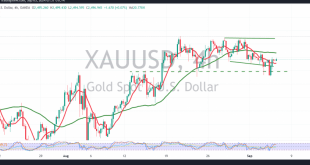

Gold prices saw positive attempts within the expected upward trend mentioned in the previous report, reaching a high of around $2,500 per ounce. From a technical standpoint today, after achieving the official target of $2,470 earlier this week, we note that the price has stabilized above this level, encouraging clear …

Read More »Oil suffers huge losses 4/9/2024

U.S. crude oil futures experienced significant losses, surpassing the downside targets set in the previous trading session at 72.20, and recording a low of 69.75 during today’s Asian session. Technically, the 4-hour chart indicates that the bearish technical structure remains intact and effective, further reinforced by the ongoing negative pressure …

Read More »Gold touches targets and tries to recover 4/9/2024

Gold prices suffered significant losses yesterday, as anticipated in our previous technical report, reaching the key levels of 2486 and then 2470, with a low of $2473 per ounce. From a technical standpoint today, we observe that gold has momentarily stabilized above 2486 and generally above 2476. A closer look …

Read More »Oil: Double Top Pressures Price 3/9/2024

U.S. crude oil futures have experienced a significant decline, marking the worst monthly performance since the beginning of the year. Oil prices lost nearly 6.15% during August, reaching a low of approximately $72.90 per barrel yesterday. From a technical standpoint, the 4-hour chart reveals a bearish pattern, suggesting a continued …

Read More »Gold faces selling pressure 3/9/2024

Gold prices experienced a mild downward trend during the previous trading session, attempting to stabilize above the psychological resistance level of 2500, but ultimately closed the day below this threshold. From a technical standpoint, the price is under selling pressure, largely due to its position below the 50-day simple moving …

Read More »Euro weathered the storm of negative data

Euro has shown resilience despite weaker-than-expected German economic data released on Tuesday. This data highlighted a deterioration in consumer confidence within the Eurozone. The German GfK consumer confidence index fell to -22.0 in September, compared to -18.6 in August, reflecting growing pessimism among European consumers about the economic outlook. Additionally, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations