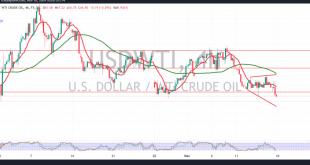

US crude oil futures experienced sharp declines at the start of the week, bottoming out at $66.84 per barrel. From a technical standpoint, the 4-hour chart reveals that oil prices have decisively broken below the support level of $68.65. The persistent downward pressure from the simple moving averages continues to …

Read More »Gold: Negative pressure continues 18/11/2024

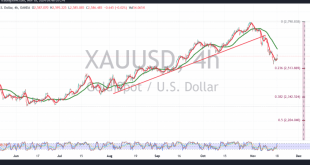

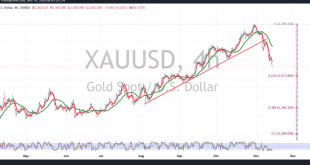

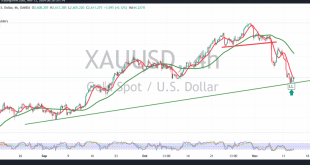

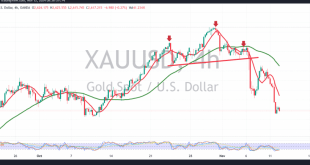

Gold prices fell at the end of last week’s trading, breaking below the support line of the ascending channel, as highlighted in the previous report. This break extended losses, with gold reaching a low of $2554 per ounce. From a technical analysis perspective, gold has attempted to stage a minor …

Read More »Oil faces negative pressure 14/11/2024

US crude oil futures have reached the official target outlined in our previous technical report, hitting a low of $66.67 per barrel after touching the 67.00 mark. From a technical standpoint, the 4-hour chart indicates that oil attempted an upward rebound upon testing the psychological support at 67.00. Nevertheless, despite …

Read More »Gold below the uptrend line 14/11/2024

Gold prices have continued their significant decline, reversing the upward correction scenario outlined in our previous technical report. This analysis had emphasized that maintaining stability above the support line of the ascending channel was crucial. The breach below the 2600 level, however, has led gold prices to resume their downward …

Read More »Oil stable below resistance 13/11/2024

US crude oil futures experienced mixed trading, attempting to pare losses after reaching a low of $67.78 per barrel. From a technical standpoint, oil prices remain under negative pressure, driven by continued movement below the simple moving averages. Additionally, the price is currently stabilizing below the key resistance level at …

Read More »Gold rests on trend line support 13/11/2024

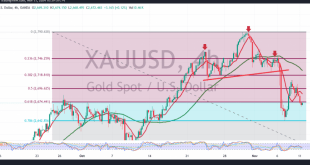

Gold prices faced significant selling pressure during the previous trading session, aligning with our anticipated bearish outlook. The metal reached the official target of the ongoing downtrend at $2589 per ounce, marking its lowest point at $2589. On the technical side, gold has established a solid support base around $2589, …

Read More »Oil continues to make losses 12/11/2024

US crude oil futures prices experienced a significant decline in the last trading session, aligning with the bearish outlook, and met the forecasted targets at 68.55, hitting a session low of $67.84 per barrel. Technical Analysis: Bearish Bias: Oil prices are currently under negative pressure, with trading stability below 68.60. …

Read More »Gold is subject to heavy selling 12/11/2024

Gold experienced strong selling pressure, maintaining its downward trend and surpassing the target station of 2647, with prices dropping to a low of $2610 per ounce. Technical Analysis: Bearish Outlook: Today’s analysis indicates a continued bearish sentiment, as gold remains below the simple moving averages, which reinforce the likelihood of …

Read More »Oil settles below support 11/11/2024

US crude oil futures experienced a significant decline last week, hitting a low of $69.95 per barrel. Technical Analysis: Bearish Momentum: Oil prices are under negative pressure, with intraday trading staying below the 70.60 resistance level. The price continues to trade under the 50-day simple moving average, reinforcing the bearish …

Read More »Gold: Negative pressure persists 11/11/2024

Gold prices remain under continuous bearish pressure, registering a new session low at 2666 per ounce in morning trading. Technical Analysis: Bearish Trend Confirmation: The break below the 2674 level, corresponding to the 61.80% Fibonacci retracement, reinforces the downside momentum. Additionally, the price struggles to overcome the 2700 psychological resistance, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations