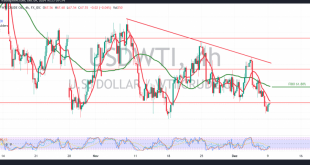

US crude oil futures prices continue their bearish trajectory, aligning with the previous negative outlook. The price reached the official target at 67.00, recording a low of $67.05 per barrel. Technical Analysis: 240-Minute Chart Observations: The simple moving averages maintain downward pressure. The 14-day momentum indicator shows strong negative signals, …

Read More »Gold needs catalysts 9/12/2024

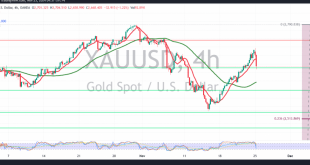

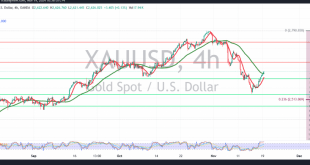

Gold prices continue to trade within a sideways range, remaining constrained between 2620 as support and 2655 as the main resistance level. Technical Analysis: 4-Hour Chart Insights: The simple moving average is attempting to provide a positive push to prices. Meanwhile, the Stochastic indicator shows persistent negative signals, reflecting conflicting …

Read More »Oil awaits new move signal 5/12/2024

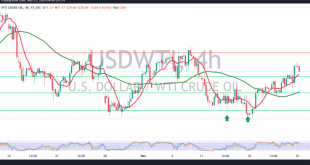

US crude oil futures demonstrated the anticipated upward trend outlined in the previous technical report, supported by trading stability above the key level of 68.90. Technical Analysis: Bearish Indicators: The simple moving averages apply continued downward pressure. The 14-day momentum indicator reflects clear negative signals, favoring a bearish outlook. Scenario …

Read More »Gold is moving in a sideways range 5/12/2024

Gold continues to exhibit a sideways trend, trading within a narrow range confined between the support level at 2635 and resistance level at 2657 for several consecutive sessions. Technical Analysis: Positive Signals: The 50-day simple moving average provides upward pressure, hinting at the possibility of a bullish breakout. Negative Signals: …

Read More »Oil starts positive 4/12/2024

US crude oil futures displayed bullish attempts in the previous session, reaching a high of $70.20 per barrel. From a technical perspective, the outlook remains positive, supported by the bullish crossover of simple moving averages that align with the daily upward trajectory. Furthermore, the price stability above the key support …

Read More »Gold needs to find a stronger direction 4/12/2024

Gold continues to exhibit sideways movement, with prices stabilizing above the support level at 2634 and below the pivotal resistance at 2658. From a technical perspective, the 4-hour chart reflects conflicting signals. The 50-day simple moving average exerts downward pressure, favoring a bearish trend, while the 14-day momentum indicator provides …

Read More »Oil is based on support 25/11/2024

US crude oil futures closed last week’s trading on a positive note, reaching a high of $71.47 per barrel. From a technical standpoint, the outlook remains optimistic, supported by the price’s ability to stabilize above the key support level of $70.60. Additionally, the RSI is showing attempts to gain further …

Read More »Gold to be monitored 25/11/2024

Gold resumed its bullish momentum during the previous session, surpassing the official target of $2700 per ounce and recording its highest level at $2720. From a technical perspective, the current movement shows a slight bearish tendency due to encountering the pivotal resistance at $2720. However, a closer look at the …

Read More »Oil breaks resistance 19/11/2024

US crude oil futures have shown a strong upward momentum, crossing a key resistance level at 68.65, signaling a shift toward a potential bullish trend. Technical Analysis Overview:On the 240-minute chart, the technical setup is promising, with the 14-day momentum indicator attempting to generate positive signals. Furthermore, the 50-day simple …

Read More »Gold starts positively 19/11/2024

Gold prices showed strong upward momentum in the previous session, successfully building on the support level of 2567 and reversing the anticipated downward trend from the prior analysis. As highlighted earlier, surpassing 2604 was a significant catalyst, paving the way for a potential shift toward an upward trajectory, with prices …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations