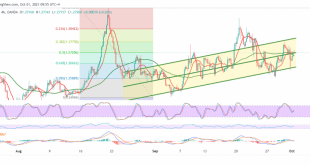

Negative trading dominated the Canadian dollar’s movements during the previous trading session after it succeeded in stabilizing temporarily below the 1.2600 support level. From the technical analysis, the current moves are witnessing attempts to rise. However, the price is back to stability above the 1.2600 support level, accompanied by attempts …

Read More »Gold Hit The Resistance

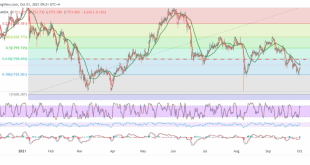

Gold recorded rebound attacks to the upside during the previous trading session to retest the 1770 resistance level after recording its lowest level at 1747. Today’s technical vision indicates the possibility of resuming the bearish bias based on the negative pressure of the 50-day moving average, in addition to the …

Read More »German Dax Continues to Decline

Negative trading dominates the German DAX index movements, settling around the lowest level during today’s trading session at 15,080. Technically, and with the stability of trading below support-into-resistance 15280 level, accompanied by the negative pressure of the simple moving averages. This increases the possibility that we will witness a downward …

Read More »CAD Awaits Pending Orders

The Canadian dollar faced intense negative pressure at the end of last week’s trading. It started the first weekly trading with a bearish tendency; after it failed to settle above the 1.2665 level, it started the first weekly trading with a bearish tendency. Technically, we notice a contradiction between the …

Read More »Gold Hovers Around Resistance

Gold’s movements are witnessing rebound attacks to the upside, which aimed to retest the 1767 resistance level after a, which recorded its lowest level around the 1722 bottom. On the technical side, we find gold collided with the resistance level of the descending price channel shown on the graph, which …

Read More »Germany’s DAX Suffers Big Losses

The German DAX index declined significantly, recording heavy losses during the trading session of the last session, reaching its lowest level at 15,090 during the morning session of today’s session. Technically, we notice the continuation of the negative pressure coming from the 50-day moving average, which continues to pressure the …

Read More »CAD at Solid Support

The Canadian dollar found solid support around the 1.2630 level, which forced it to trade positively again within a bullish bounce that aimed to retest 1.2720. Technically, today, the current moves see the price stability above the 1.2660 support level at the 61.80% Fibonacci level. We also notice the positive …

Read More »Gold Trying Positively

. The yellow metal prices touched the target at 1726, recording its lowest level around 1722 within a strong bearish trend. On the technical side today, and by looking at the 240-minute chart, we notice that some bullish bias yesterday’s session, taking advantage of the pivot on the support level …

Read More »German Dax Looking For Signals

Mixed trading dominates the movements of the German DAX index, trying to repeat the chances of the bullish attack to the upside, recording its highest price of 15,698. On the technical side today, and by looking at the 60-minute chart, we notice the RSI’s attempts to gain bullish momentum, in …

Read More »CAD Touches Goal

The Canadian dollar returned to the strong resistance located at 1.2670, which forced it to trade negatively again, heading to touch the first target of 1.2600, to record its lowest level at 1.2600 during the early trading of the current session. Technically, with the clear negativity on the stochastic indicator, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations