In the previous report, we maintained a neutral stance due to conflicting technical signals, noting that a confirmed breach of the 2755 resistance level could lead to a new upward wave, targeting 2765, with the price reaching a high of $2766 per ounce. From a technical perspective today, the 4-hour …

Read More »Oil: Bearish Technical Structure 28/1/2025

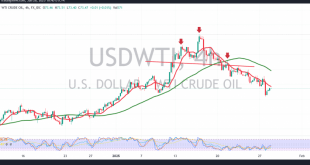

A bearish trend dominated US crude oil futures prices during the early trading sessions this week, with prices reaching their lowest level at $72.42 per barrel. From a technical standpoint, examining the 4-hour chart reveals the formation of a bearish inverted head and shoulders pattern. Additionally, oil prices remain below …

Read More »Gold is waiting for a signal to move 28/1/2025

Negative trading dominated gold’s movements as anticipated in the previous report, reaching the first target of 2735 and recording its lowest level at $2730 per ounce. Today’s technical outlook suggests the possibility of continuing the downward trend. However, upon closer examination, there appears to be a conflict between technical indicators. …

Read More »Weekly Recap: US Jobs data slams Wallstreet shares amid earnings anticipation

Last week was eventful, marked by a series of significant developments. These included policy directions anticipated from President-elect Donald Trump’s administration, future paths for central banks, particularly the Federal Reserve, and the impact of key US economic releases. The Eurozone has seen significant developments, particularly CPI front. Several European leaders …

Read More »Oil needs positive stimulus to continue rising 3/1/2025

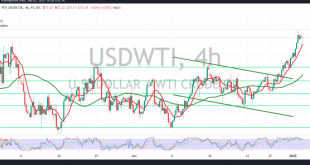

US crude oil futures posted notable gains during the previous session, aligning with the positive outlook outlined in the prior report. The price reached the official target of 73.00, recording a high of $73.69 per barrel. Technical Outlook:The technical indicators continue to favor a bullish bias. The simple moving averages …

Read More »Gold is a positive 3/1/2025

Gold prices surged during the previous trading session, successfully breaching the strong resistance level highlighted in the previous report. This breach temporarily halted the downward trend and triggered a rise, with the metal reaching a high of $2665 per ounce, surpassing the initial targets of 2645 and 2657. Technical Outlook:A …

Read More »Oil may extend gains 2/1/2025

US crude oil futures maintained an upward trajectory in line with the positive outlook outlined in the previous report, successfully reaching the anticipated target of $72.20 and recording a peak of $72.25 per barrel. Technical Outlook:The bullish bias remains dominant, supported by positive momentum from the simple moving averages and …

Read More »Gold tries to recover 2/1/2025

Gold prices are attempting a modest upward correction during the early trading sessions of this week, reaching a high of $2636 per ounce in today’s initial trades. Technical Analysis:A closer examination of the 4-hour chart reveals that the Stochastic indicator has entered overbought territory, coinciding with the price’s continued movement …

Read More »Oil starts positively 30/12/2024

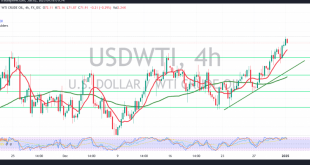

US crude oil futures regained upward momentum, starting the day positively and reaching an intraday high of $70.70 per barrel during early trading. Technical Analysis: Positive signals from the 14-day momentum indicator, coupled with support from the simple moving averages, favor continued upward movement. With intraday stability above $70.00, and …

Read More »Gold tends to be negative 30/12/2024

Gold prices maintained their downward trend, albeit with weakened momentum, reaching a low of $2611 per ounce by the end of last week’s trading session. Technical Analysis: A closer examination of the 4-hour chart reveals the Stochastic indicator losing upward momentum, while prices remain stable below the 50-day simple moving …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations