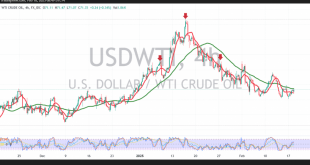

U.S. crude oil futures experienced a sharp decline, aligning with our previous technical outlook, reaching the first target at $68.85 and coming within a few points of the next official support at $67.80, recording a low of $67.85 per barrel. Technical Outlook A closer look at the 4-hour chart shows …

Read More »Gold needs monitoring of price behavior 4/3/2025

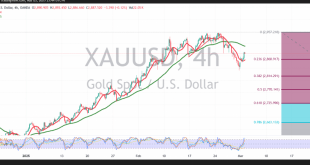

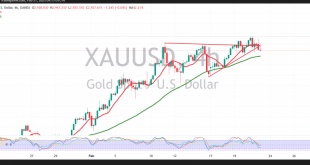

Gold prices exhibited positive movement in the previous session, attempting to halt the ongoing downward correction and showing temporary stability above 2884. From a technical perspective, despite the bullish momentum observed yesterday, a closer look at the 4-hour chart reveals that the price remains stable above 2868, which corresponds to …

Read More »CAD breaks through resistance 3/3/2025

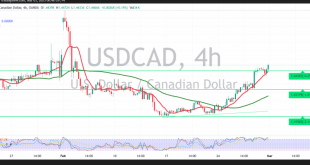

The Canadian dollar surged against the U.S. dollar, posting notable gains after successfully rebounding from the support level at 1.4370, reaching a high of 1.4472. From a technical perspective, the 4-hour chart indicates that the simple moving averages continue to provide support from below, reinforcing the potential for further upside. …

Read More »Oil retests resistance 3/3/2025

U.S. crude oil futures attempted to rise, reaching a high of $70.51 per barrel but failed to maintain stability above the key psychological resistance at $70.00. From a technical perspective, the 4-hour chart indicates bearish momentum, as the Relative Strength Index (RSI) remains below the 50 midline, coupled with a …

Read More »Gold experiencing negative pressure 3/3/2025

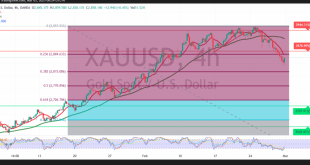

Gold prices suffered heavy losses at the end of last week’s trading amid profit-taking, reaching a low of $2,832 per ounce. From a technical analysis perspective, the 4-hour chart shows clear negative crossover signals on the simple moving averages, reinforced by bearish indications on the 14-day momentum indicator. Given these …

Read More »CAD May Resume Downside Correction 21/2/2025

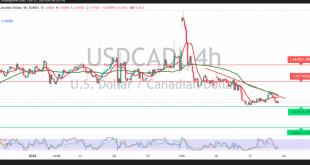

The Canadian dollar retreated, moving away from its recent high of 1.4306, initiating a downward correction. Currently, the pair is stabilizing near its session low of 1.4166. Technical Analysis On the 4-hour chart, the simple moving averages (SMA) are exerting negative pressure on the price, reinforcing the possibility of continued …

Read More »Oil to be monitored 21/2/2025

U.S. crude oil futures continued their upward momentum for the third consecutive session, reaching a high of $73.11 per barrel. Technical Analysis On the 4-hour chart, a bullish crossover of the simple moving averages (SMA) supports the potential for further gains. However, Stochastic indicators suggest a loss of upward momentum, …

Read More »Gold: Retest Scenario 21/2/2025

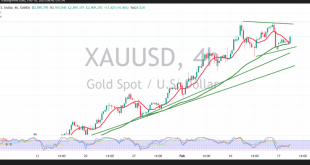

Gold Hits Record Highs Before Facing Profit-Taking Pressure Gold prices extended their rally in the previous trading session, surpassing the key $2,950 per ounce target and reaching a new high of $2,954. Technical Analysis Despite the strong long-term bullish trend, intraday movements indicate a bearish pullback due to profit-taking and …

Read More »Oil awaits negative stimulus 18/2/2025

US Crude Oil (WTI) Technical Analysis US crude oil futures saw temporary positive movements, reaching $71.47 per barrel during this morning’s trading. Technical Outlook: Bearish Signals: The simple moving averages (SMA) continue to pressure the price from above. The Stochastic indicator is losing upward momentum, signaling potential weakness. Key Support …

Read More »Gold tries to regain the upward path 18/2/2025

Gold (XAU/USD) Technical Analysis Gold prices began today’s trading with an upward trend after last Friday’s decline and profit-taking pushed prices down to $2878 per ounce. Technical Outlook: Bullish Signals: The price remains stable above the 50-day simple moving average (SMA). Intraday support is confirmed at 2887, with a broader …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations