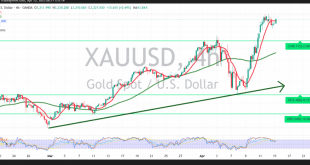

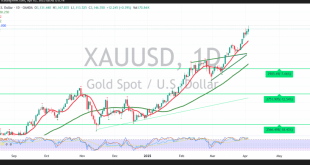

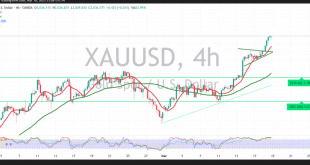

The key support level highlighted in the previous technical report at $3,190 successfully held, helping to maintain the broader upward trend. Following a rebound from this level, gold prices have resumed their climb, currently trading around $3,228 per ounce at the time of writing. On the 4-hour chart, price action …

Read More »CAD threatens to break support 3/4/2025

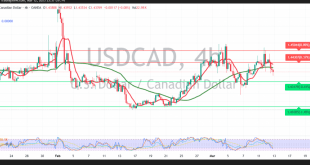

The Canadian dollar has pulled back after a streak of gains, encountering strong resistance at 1.4360. This level prompted a reversal, with the pair declining to a session low near 1.4215. From a technical standpoint, the 4-hour chart highlights notable resistance just below the 50-period simple moving average, alongside clear …

Read More »Oil below the moving average 3/4/2025

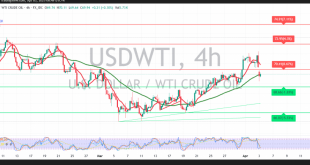

U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More »Gold reaches unprecedented highs 3/4/2025

Gold continues its record-breaking rally, reaching $3,167 per ounce during early trading this morning—hitting the official target outlined in the previous technical report. From a technical analysis perspective, the 4-hour chart reflects a strong bullish structure, reinforcing the continuation of the current upward trend. Price action remains comfortably above key …

Read More »CAD trying to make up for the losses 19/3/2025

The Canadian dollar successfully reached the anticipated bearish targets during Monday’s trading session, hitting a low of 1.4265 after achieving the 1.4270 target. From a technical standpoint, the 4-hour chart indicates that the pair found solid support around 1.4260, prompting a minor bullish rebound. The stochastic indicator has entered the …

Read More »Oil breaks intraday support 19/3/2025

U.S. crude oil futures have staged a strong rebound, aligning with the anticipated positive outlook from the latest technical analysis. A breakout above $67.20 acted as a catalyst, driving prices higher to a peak of $68.45 per barrel. From a technical perspective, the outlook remains cautious with a slight bearish …

Read More »Gold continues to record highs, all eyes on Fed 19/3/2025

Gold prices continue their record-breaking rally, surpassing the previous peak and setting a new all-time high near $3,038 per ounce, exceeding the projected target of $3,020. From a technical perspective, the 4-hour chart shows that gold remains well-supported by the simple moving averages, which continue to reinforce the upward trend. …

Read More »CAD maintains negative stability 13/3/2025

The USD/CAD pair has been under bearish pressure after encountering strong resistance near 1.4485, leading to a downward bias. A close examination of the 4-hour chart reveals emerging negative signals on the Stochastic indicator, along with price stability below 1.4470, reinforcing the possibility of a bearish continuation. If the bearish …

Read More »Oil is trying to form an upward rebound 13/3/2025

After several consecutive sessions of decline, U.S. crude oil futures have staged a bullish rebound, attempting to hold above the psychological barrier of 67.00. Technical Analysis On the 4-hour chart, we maintain a cautiously positive outlook, supported by the Relative Strength Index (RSI) attempting to gain upward momentum and the …

Read More »Gold attacks resistance and needs a positive stimulus 13/3/2025

We previously maintained a neutral stance, emphasizing the need to monitor price behavior around the 2930 resistance level. A confirmed breakout above this level was expected to pave the way for a return to 2940, which was successfully achieved, marking a record high of $2940 per ounce. Technical Analysis On …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations