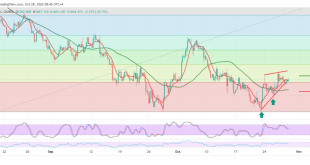

The technical outlook is unchanged, and the movements of the Canadian dollar did not change, maintaining the expected bearish context and the regular movements within the descending channel. Technically and carefully considering the 4-hour chart, we find the simple moving averages continuing their negative pressure on the price from above, …

Read More »Oil touches the first target 28/10/2022

A weak bullish trend dominated the movements of US crude oil futures yesterday, within the expected bullish context, touching the first target required to be achieved at 89.60, recording the highest level at 89.80. Technically, we tend in our trading to the positive, but cautiously, relying on the positive stimulus …

Read More »Gold is facing negative pressure 28/10/2022

Narrow sideways trading tended to the negativity that dominated gold’s movements during the previous session, under pressure from the rise of the US dollar, reaching the lowest of 1654, after it failed to cross upwards to the resistance level of 1670. Technically, the 50-day simple moving average is trying to …

Read More »CAD continues to descend towards the goals 27/10/2022

The Canadian dollar achieved the negative targets required during the previous technical report to reach the first target at 1.3545, approaching by a few points from the second target of 1.3495, recording the lowest level at 1.3505. Technically and carefully considering the 4-hour chart, we find the simple moving averages …

Read More »Oil breaks through resistance and rises cautiously 27/10/2022

US crude oil futures prices reversed the expected bearish trend during the latest analysis after the report issued by the International Energy Agency on oil inventories, recording extended gains around $88.47 per barrel. Technically, today, the current moves are witnessing stability above the previously breached resistance level, which is now …

Read More »Gold needs extra momentum to continue rising 27/10/2022

We remained neutral during the previous session’s trading, explaining that we are waiting for the activation of the pending orders due to the conflicting technical signals at the time of the report’s release, explaining that activating the buying positions depends on confirming the breach of 1666 to target 1677, recording …

Read More »CAD may see further declines ahead of the BoC decision 26/10/2022

The Canadian dollar is trading with noticeable negativity after it failed to maintain positive stability above the 1.3655 support level, to witness the current movements of the pair stabilizing around its lowest level during the early trading of the current session, around 1.3595. Technically, we tend in our trading to …

Read More »Oil: Negative pressure remains 26/10/2022

Divergent movements still dominate the prices of US crude oil futures contracts amid conflicting data about the energy markets, reaching its highest level during the previous session’s trading of $86.00 per barrel. Technically, the 50-day simple moving average is still an obstacle in front of the price, and the bearish …

Read More »Gold is waiting for a new signal 26/10/2022

Gold attempts continue to rise, but still limited attempts are ineffective after a strong confrontation with the pivotal resistance level published during the previous analysis at1660 price, which still constitutes an obstacle to the price until now, unable to break it. On the technical side, and by looking at the …

Read More »CAD trying to build on support 24/10/2022

Negative trading returned to control the Canadian dollar after hitting the resistance level of 1.3850, which forced the pair to trade negatively again, touching the level of 1.3610. Technically, and carefully considering the 4-hour chart, we find the pair trying to build a base on the 1.3680 support level and, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations