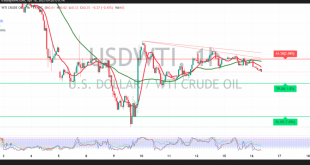

U.S. crude oil futures aligned with the expected upward movement in the previous session, as the price held above the pivotal $61.20 support level. Although the market briefly dipped to $60.11, triggering a pullback that offset earlier long positions, the broader technical structure remains constructive. On the 4-hour chart, the …

Read More »Gold Risks Further Loss of Momentum 16/5/2025

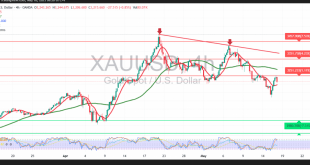

Gold prices declined sharply in the previous session, pressured by profit-taking after strong gains earlier in the year. The market reached key downside targets outlined in the previous report, with prices falling Gold prices saw mixed trading in the previous session, briefly approaching the first downside target at $3,112 before …

Read More »CAD starts positively 15/5/2025

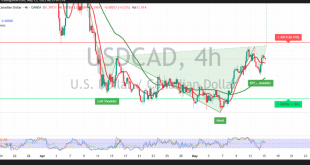

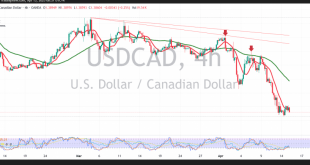

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base around the psychological level of 1.3900. From a technical standpoint, the 4-hour chart indicates that bullish momentum is gaining traction. The pair is now supported by upward-sloping simple moving averages, which are once again acting …

Read More »Oil hovers near support, Eyes potential rebound 15/5/2025

U.S. crude oil futures are currently trading with a bearish tone, following a retreat from the recent high of $63.64 per barrel recorded in the previous session. Technically, the price is attempting to stabilize near the key support level at $61.20, suggesting the possibility of a short-term rebound. This potential …

Read More »Gold breaks through uptrend support line 15/5/2025

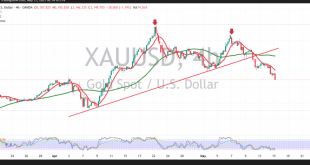

Gold prices declined sharply in the previous session, pressured by profit-taking after strong gains earlier in the year. The market reached key downside targets outlined in the previous report, with prices falling to a low of $3,148 during early trading today. From a technical perspective, the 4-hour chart reveals a …

Read More »CAD is trending down, all eyes on BoC 16/4/2025

The Canadian dollar remains under sustained downward pressure, with the pair extending its losses over several consecutive sessions and reaching a recent low of 1.3828. From a technical standpoint, the 4-hour chart confirms the continuation of the dominant downtrend. Price action remains firmly below the key simple moving averages, which …

Read More »Oil hits resistance 16/4/2025

U.S. crude oil futures are facing strong resistance near the $61.60 level, which has exerted downward pressure on prices. As a result, oil has retreated and is currently trading around $60.50 per barrel. From a technical perspective, the 50-period simple moving average—hovering near the $61.50 zone—is acting as a firm …

Read More »Gold continues its meteoric rise 16/4/2025

Gold prices continue to surge within the framework of a strong upward trend, as anticipated in previous reports. The metal has successfully reached the official target at $3,274 and recorded a new session high of $3,286 per ounce during early morning trading. On the 4-hour chart, price action remains firmly …

Read More »CAD continues to decline 15/4/2025

The Canadian dollar remains under sustained downward pressure, with the pair extending its losses over several consecutive sessions and reaching a recent low of 1.3828. From a technical standpoint, the 4-hour chart confirms the continuation of the dominant downtrend. Price action remains firmly below the key simple moving averages, which …

Read More »Oil is trying to break through the resistance 15/4/2025

U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations