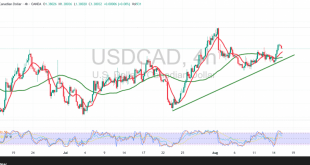

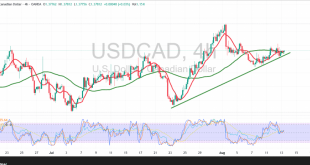

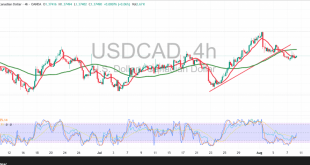

An upward trend took hold of the USD/CAD pair after several sessions of sideways movement, with the pair reaching its highest level in the previous session at 1.3820. Technical Outlook – 4-hour timeframe: Following yesterday’s rise, intraday price action is showing a natural pullback, yet the pair remains firmly above …

Read More »Oil Eyes Key Level – Bulls VS Bears — Can They Hold On? 15/8/2025

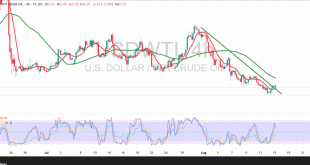

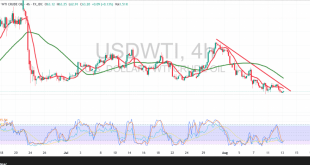

An upward trend has dominated US crude oil futures, with prices attempting to recover losses from previous sessions. Technical Outlook – 4-hour timeframe: US crude has established solid support at $62.00, while the 50-period simple moving average continues to act as dynamic resistance from above. The Relative Strength Index (RSI) …

Read More »Gold Slips as Dollar Strength 15/8/2025

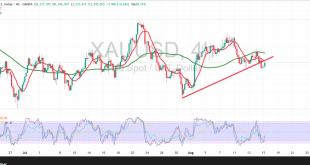

Gold prices (XAU/USD) recorded a sharp decline in the previous session after stronger US inflation data boosted the dollar at the expense of the precious metal, sending prices to a low of $3,329. Technical Outlook – 4-hour timeframe: Intraday price action shows only limited rebound attempts, as the 50-period simple …

Read More »CAD Caught Between Support and Resistance Battle 13/8/2025

The USD/CAD pair is trading within a narrow sideways range, supported at 1.3750 and capped by resistance just below 1.3800. Technical Outlook – 4-hour timeframe: Technical indicators point to a possible resumption of the uptrend, backed by the 50-period simple moving average, which continues to provide support. However, early signs …

Read More »Oil Under Pressure… Sellers Dominate the Scene 13/8/2025

In our previous report, we maintained a bearish outlook, and US WTI crude oil futures extended their decline, recording a low of $62.97 per barrel. Technical Outlook – 4-hour timeframe: Selling pressure remains strong as prices continue to trade below the simple moving averages, which serve as a firm barrier …

Read More »Gold Struggles at Crucial Threshold — Support or Resistance to Give Way? 13/8/2025

Gold prices (XAU/USD) experienced mixed but predominantly negative movement, reaching their lowest level in the previous session at $3,331 per ounce. Technical Outlook – 4-hour timeframe: During mid-day trading yesterday, gold attempted a modest rebound after the Relative Strength Index (RSI) entered sharp oversold territory, triggering limited upside movement. However, …

Read More »CAD Holds Steady Amid Unchanged Technical Setup 8/8/2025

Mixed price action characterized the USD/CAD pair during the previous trading session, as the pair tested the 1.3770 resistance level, which effectively capped the weak bullish attempts. Technical Outlook: Current technical indicators suggest a potential resumption of the broader downtrend. This is reinforced by continued pressure from the 50-period Simple …

Read More »Oil Slips Below $65 Resistance as Bearish Trend Takes Hold 8/8/2025

In our previous technical report, we maintained a neutral stance due to conflicting signals. However, recent price action has confirmed the continued dominance of the downtrend, with U.S. crude oil futures experiencing renewed bearish pressure in recent hours. Technical Outlook: After testing the strong psychological resistance at $65.00, prices sharply …

Read More »Strong Momentum Pushes Gold Higher — What Lies Beyond $3,400? 8/8/2025

Gold prices extended their strong upward momentum, fully aligned with the positive outlook outlined in our previous report. The metal reached the official bullish targets, climbing to a session high of $3,409 per ounce during early trading. Technical Outlook: After reaching the key psychological resistance at $3,400, gold is showing …

Read More »Canadian Dollar Breaks the Uptrend Line 7/8/2025

In our previous report, we maintained a neutral stance due to conflicting market signals. However, a clear bearish development has since occurred, as the support level at 1.3760 was broken, potentially triggered by early-session momentum at 1.3720. The pair has since recorded its lowest level of the session at 1.3729. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations