Consumer spending momentum eases U.K. consumer spending rose 2.1% year-on-year in the four weeks ending August 29, according to Barclays’ latest U.K. Spend Trends report released on Wednesday. The figure represents a slowdown from the 2.5% growth recorded in the four weeks ending July 4, but still outpaces the longer-term …

Read More »Pound Maintains Bullish Momentum 9/9/2025

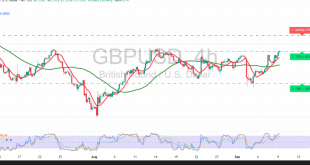

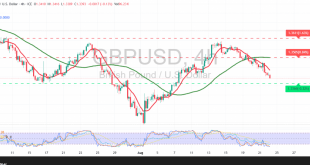

The technical outlook for the GBP/USD pair remains unchanged, with price action showing little variation as the pair continues its gradual intraday recovery, attempting to hold above the key psychological support at 1.3500. Technical Outlook – 4-hour timeframe: The Relative Strength Index (RSI) has cleared oversold territory and is beginning …

Read More »Pound Picks Up Positive Signals 8/9/2025

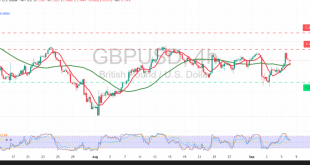

The GBP/USD pair continues its gradual intraday recovery, attempting to consolidate above the key psychological support at 1.3500. Technical Outlook – 4-hour timeframe: The Relative Strength Index (RSI) has successfully exited oversold territory and is beginning to deliver positive signals that could restore bullish momentum. In addition, price action is …

Read More »Pound Stumbles Against the Dollar 3/9/2025

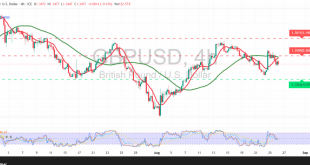

The GBP/USD pair posted sharp losses in the previous trading session after encountering strong resistance at 1.3550, the prior target level. Technical Outlook – 4-hour timeframe: Current price action reflects a clear bearish bias following a break of the short-term ascending trend line. In addition, the pair continues to trade …

Read More »GBP/USD May Hold on to Its Gains 2/9/2025

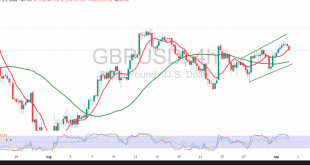

The GBP/USD pair posted strong gains in the first trading session of the week, supported by weakness in the US dollar, and reached a new high near the 1.3550 target. Technical Outlook – 4-hour timeframe: Intraday price action is showing a mild bearish bias as a result of profit-taking following …

Read More »GBP/USD Maintains Bullish Path/8/2025

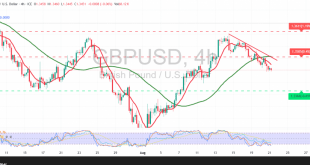

An uptrend has successfully taken control of GBP/USD trading, in line with the positive outlook highlighted in our previous technical report. The pair reached the projected target at the first resistance of 1.3500, recording a high of 1.3518. Technical Outlook – 4-hour timeframe: The price has firmly established itself above …

Read More »GBP Tries to Capture Bullish Momentum 27/8/2025

The GBP/USD pair is under negative pressure in the morning session as it approaches the psychological resistance level of 1.3500. Technical Outlook – 4-hour timeframe: The pair’s stability below the simple moving average continues to reinforce the possibility of extended downside pressure. However, the Relative Strength Index (RSI) has started …

Read More »Bearish Technicals Weigh Heavily on GBP 26/8/2025

Negative trading dominated the movements of the GBP/USD pair during the morning session, following its failure to achieve a daily close above the psychological resistance at 1.3500. Technical Outlook – 4-hour timeframe: The pair’s continued stability below the simple moving average strengthens the likelihood of sustained selling pressure, particularly with …

Read More »Technical Signals Suggest Continued Pressure on the Pound 22-8-2025

The GBP-USD pair successfully touched its first target of 1.3420 during the previous session, reaching its lowest level during today’s morning session at 1.3393. Technical Outlook – 4-Hour Timeframe The price’s continued stability below the Simple Moving Average increases the likelihood of extended selling pressure, especially with the clear negative …

Read More »Pound Sterling Under Pressure Against the Dollar – 21/08/2025

The GBP/USD pair has successfully reached its first downward target at 1.3445, as we noted in the previous report. It is currently stabilizing near its lowest levels, around 1.3447. Technical Outlook – 4-Hour Timeframe Continued trading below the Simple Moving Average reinforces the possibility of a continued downward path, especially …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations