Oil futures eased slightly on Monday after reaching their highest levels in weeks, as traders booked profits ahead of the Federal Reserve’s final policy meeting of the year. Despite the decline, prices remain supported by fears of supply disruptions linked to potential U.S. sanctions on major oil exporters like Russia …

Read More »Oil may repeat attempts to rise 16/12/2024

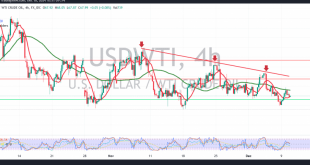

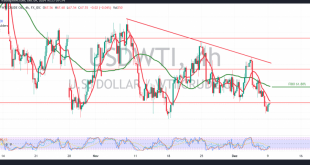

Mixed trading dominated the movements of US crude oil futures, with prices reaching the initial target highlighted in the previous technical report at 71.10, and recording a high of $71.38 per barrel. From a technical perspective, the 240-minute chart indicates that prices are currently stabilizing above the minor support level …

Read More »Crude oil swings around $70 ahead of hoped weekly gains

Crude oil prices have recently seen a surge, pushing crude oil futures above the $70 per barrel mark. While this upward trend is fueled by factors like OPEC+ production cuts and geopolitical tensions, a closer look reveals a more complex picture. The recent rally in oil prices is a testament …

Read More »Oil Markets Stumble as Supply Concerns Overshadow Demand Hopes

Oil prices retreated this week, unable to sustain the momentum from the previous day’s rally. A confluence of factors, including a downward revision to global oil demand forecasts by OPEC, a strengthening US Dollar, and ample supply prospects, weighed on market sentiment. The Organization of the Petroleum Exporting Countries (OPEC) …

Read More »Oil extends gains 12/12/2024

US crude oil futures experienced significant upward momentum, breaking the pivotal resistance level of $68.60 to achieve the anticipated targets from the previous session, reaching $70.50 per barrel. Technical Analysis A closer examination of the 4-hour chart reveals: Support Levels: The price currently holds above minor support at $69.60, with …

Read More »Oil Prices Edge Higher on China’s Policy Signals and Demand Optimism

Oil prices rose on Wednesday as market optimism grew regarding potential demand recovery in China, the world’s largest crude importer, following Beijing’s announcement of a significant monetary policy shift aimed at spurring economic growth. Market Overview Brent Crude Futures: Up 24 cents (0.3%) to $72.43 a barrel by 0730 GMT. …

Read More »Oil breaks resistance 11/12/2024

US crude oil futures prices reacted to the anticipated downward trend highlighted in the previous analysis. The scenario relied on trading stability below the key resistance level of 68.60. As expected, an upward move and stability above 68.60 negated the bearish outlook, resulting in a price increase to $69.08 per …

Read More »Oil hits resistance 10/12/2024

US crude oil futures attempted to move higher in the previous session, challenging the pivotal resistance level of 68.60 and reaching a peak of $68.85 per barrel. Technically, analysis of the 240-minute chart suggests that negativity prevails due to sustained downward pressure from the simple moving averages. Additionally, the price …

Read More »Oil Prices Rise as China Signals Monetary Policy Shift and Geopolitical Uncertainty Fuels Gains

Oil prices rose by more than 1% on Monday, supported by expectations of economic stimulus from China and geopolitical developments in the Middle East. China’s Policy Shift Spurs Optimism Brent crude futures climbed 94 cents, or 1.32%, to $72.06 per barrel by 0852 GMT, while U.S. West Texas Intermediate (WTI) …

Read More »Oil: Negative pressure persists 9/12/2024

US crude oil futures prices continue their bearish trajectory, aligning with the previous negative outlook. The price reached the official target at 67.00, recording a low of $67.05 per barrel. Technical Analysis: 240-Minute Chart Observations: The simple moving averages maintain downward pressure. The 14-day momentum indicator shows strong negative signals, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations