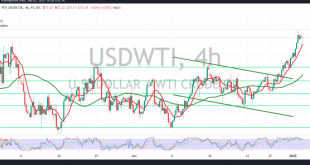

US crude oil futures posted notable gains during the previous session, aligning with the positive outlook outlined in the prior report. The price reached the official target of 73.00, recording a high of $73.69 per barrel. Technical Outlook:The technical indicators continue to favor a bullish bias. The simple moving averages …

Read More »Oil may extend gains 2/1/2025

US crude oil futures maintained an upward trajectory in line with the positive outlook outlined in the previous report, successfully reaching the anticipated target of $72.20 and recording a peak of $72.25 per barrel. Technical Outlook:The bullish bias remains dominant, supported by positive momentum from the simple moving averages and …

Read More »Despite Daily Gains, Oil Prices End Year with Losses On 2025’s Uncertainties

Oil prices concluded 2024 with a second consecutive year of losses, despite a modest increase on Tuesday. While Brent crude futures and US West Texas Intermediate (WTI) crude saw slight gains, they remain below their year-end 2023 levels, indicating a subdued market.The subdued price environment reflects a confluence of factors. …

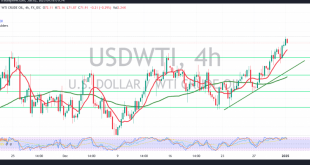

Read More »Oil starts positively 30/12/2024

US crude oil futures regained upward momentum, starting the day positively and reaching an intraday high of $70.70 per barrel during early trading. Technical Analysis: Positive signals from the 14-day momentum indicator, coupled with support from the simple moving averages, favor continued upward movement. With intraday stability above $70.00, and …

Read More »Weekly Recap: A Rocky Year’s Finish

The US stock market experienced a decline in the holiday-shortened week, with the S&P 500 and Nasdaq Composite declining by 1.1% and 1.5% respectively largely due to the performance of the communication services and information technology sectors. However, US Treasury yields have continued to rise, surpassing the 4.6% mark, largely …

Read More »What could key assets expect in the new year?

Financial markets are poised for a challenging 2025, navigating corporate transformations, geopolitical uncertainties, and economic resilience. Key factors like government policies, market dynamics, and global events will significantly impact major sectors including oil, gold, the US dollar, and cryptocurrencies.The US election outcome could trigger a long-term economic upswing, driven by …

Read More »Russian Central Bank Keeps Rates Steady at 21%, Defying Market Expectations

The Russian Central Bank surprised markets on Friday by maintaining its key interest rate at 21%, contrary to widespread expectations of a 2-percentage-point hike. Analysts had anticipated a rate increase to 23%, but the bank justified its decision by citing the effectiveness of recent tightening measures in curbing inflationary pressures. …

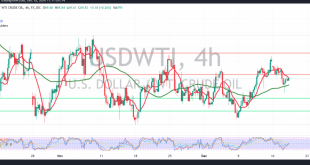

Read More »Oil stable below resistance 18/12/2024

US crude oil futures experienced a sharp decline in the previous trading session, reaching a low of $68.84 per barrel. From a technical perspective, the outlook leans negative, supported by clear bearish signals from the Relative Strength Index, which remains below the 50 midline. Furthermore, trading remains stable below the …

Read More »Oil Prices Dip Amid China Demand Woes, Caution Ahead of Fed Decision

Oil prices edged lower on Tuesday as renewed demand concerns in China weighed on sentiment, while investors adopted a cautious stance ahead of the U.S. Federal Reserve’s final policy decision of the year. West Texas Intermediate (WTI) crude fell 11 cents to $70.60 a barrel (as of 0802 GMT). Brent …

Read More »Could Trump’s drilling plan cut fuel prices and fix inflation?

President-elect Donald Trump has pledged to lower consumer prices that have soared since the pandemic, explaining how he would do so by repeating a simple mantra: “Drill, baby, drill.” He is expected to speed drilling permits that took an average of 258 days to complete during the Biden administration, hold …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations