Interviewed on Dubai TV, Muhammad Hashad, Head of Research and Development at Noor Capital and the Member of the US Association for Technical Analysts, commented on the most important developments of global financial markets on the first day of the new trading week and most importantly what is happening in …

Read More »Oil and selling pressure continues 24/4/2023

US crude oil futures prices continue to achieve losses, and oil starts with negative movements with the first trading of this week, and the current movements are witnessing stability around its lowest level during the morning trading of the current session at 78.80. Technically, prices are still operating within the …

Read More »USD/CAD’s scope to move lower based on BoC, oil prices

The USD/CAD pair is on its way to closing below 1.3400 for the lowest weekly close since February. The Canadian Dollar has some room to rise in the near future, according to MUFG Bank analysts. Analysts have been relatively skeptical about the prospects for CAD, and overall for the year, …

Read More »Oil looking for additional momentum 14/4/2023

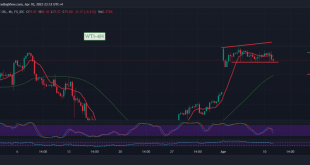

Limited positive trading dominated futures prices for US crude oil, colliding with the strong resistance published during the previous technical report at 83.50, which temporarily limited the bullish trend. Technically, by looking at the 4-hour chart, we find negativity features currently dominating the stochastic indicator. We await getting rid of …

Read More »Oil is on the rise 13/4/2023

US crude oil futures prices jumped, continuing to achieve gains during the expected wave of rise during the previous analysis, touching the official target station at 83.20, recording its highest level of $83.50 per barrel. Technically, by looking at the 240-minute chart, we find that oil prices succeeded in achieving …

Read More »Oil is rebounding after touching the bearish correction target 12/4/2023

US crude oil futures prices achieved the first corrective decline target published during the previous technical report, located at 79.30, to rebound quickly to the upside. The current movements are hovering around $81.30 per barrel. Technically, the current movements of oil are witnessing stability above the resistance of 80.80, in …

Read More »Oil is facing negative pressure and scrutiny is required 11/4/2023

We remained neutral during the last technical report due to conflicting technical signals, explaining that risks are still high amid diverging technical indicators. As a reminder, we indicated that the price’s decline below 80.00 leads oil prices to visit 79.65, recording the lowest 79.66. Technically, we tend to be negative …

Read More »Oil needs to monitor price behavior 6/4/2023

Due to conflicting technical signals, we adhered to intraday neutrality during the previous technical report, explaining the importance of monitoring the price from below 79.20 and above 80.85. Technically, prices failed to stay long above the resistance level of 80.85. Therefore, the stochastic indicator gradually lost bullish momentum, supporting the …

Read More »Oil needs to monitor price behavior for the 2nd session 5/4/2023

Due to the high level of risks amid conflicting technical signals, we adhered to intraday neutrality during the previous technical report, explaining that confirming a breach of 81.00 may extend oil’s gains to 81.60, recording its highest level at 81.80. Technically, the inconsistency in the technical signals is still present. …

Read More »Oil needs to monitor price behavior 4/4/2023

Strong rises were witnessed in the prices of US crude oil futures contracts, to start its first weekly dealings on a rising price gap under the influence of the OPEC decision, to record its highest level of $81.50 per barrel. Technically, By looking closely at the 240-minute chart, we find …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations