Oil prices edged higher on Friday, securing a second straight week of gains as tighter supply expectations took hold, driven by fresh U.S. sanctions on Iran and OPEC+’s latest production strategy. Brent crude futures climbed 16 cents, or 0.2%, to settle at $72.16 per barrel, while U.S. West Texas Intermediate …

Read More »Oil breaks intraday support 19/3/2025

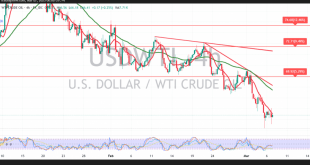

U.S. crude oil futures have staged a strong rebound, aligning with the anticipated positive outlook from the latest technical analysis. A breakout above $67.20 acted as a catalyst, driving prices higher to a peak of $68.45 per barrel. From a technical perspective, the outlook remains cautious with a slight bearish …

Read More »IEA Lowers Oil Demand Growth Forecast Amid Global Economic Concerns

The International Energy Agency (IEA) has revised its oil demand growth estimates for Q4 2024 and Q1 2025, citing worsening macroeconomic conditions driven by global trade tensions. Revised Oil Demand Forecasts The agency now expects global oil demand to increase by 1.03 million barrels per day (bpd) in 2025, down …

Read More »Oil is trying to form an upward rebound 13/3/2025

After several consecutive sessions of decline, U.S. crude oil futures have staged a bullish rebound, attempting to hold above the psychological barrier of 67.00. Technical Analysis On the 4-hour chart, we maintain a cautiously positive outlook, supported by the Relative Strength Index (RSI) attempting to gain upward momentum and the …

Read More »Oil continues to decline 11/3/2025

US crude oil futures continue their downward trend, reaching the official target of 65.75 from our previous report and recording a low of $65.80 at the time of writing. On the technical side, prices remain below the simple moving averages that support the daily downtrend, and the break of the …

Read More »Oil: Negative pressure continues 7/3/2025

US crude oil futures fell significantly, surpassing the target of 66.20 mentioned in our previous report, and reached a low of $65.62 per barrel. Technical Outlook Bearish Indicators: Prices continue to trade below the simple moving averages, reinforcing the daily downward trend. The break of the 68.20 support level—which has …

Read More »Oil is facing a selling wave 5/3/2025

US crude oil futures experienced a selling wave in line with our negative outlook, reaching the first target at $67.20 and recording a low of $66.80 per barrel. Technical Outlook Bearish Signals: Prices continue to trade below the simple moving averages, reinforcing the daily downward trend. The break of the …

Read More »Oil touches official target 4/3/2025

U.S. crude oil futures experienced a sharp decline, aligning with our previous technical outlook, reaching the first target at $68.85 and coming within a few points of the next official support at $67.80, recording a low of $67.85 per barrel. Technical Outlook A closer look at the 4-hour chart shows …

Read More »Oil retests resistance 3/3/2025

U.S. crude oil futures attempted to rise, reaching a high of $70.51 per barrel but failed to maintain stability above the key psychological resistance at $70.00. From a technical perspective, the 4-hour chart indicates bearish momentum, as the Relative Strength Index (RSI) remains below the 50 midline, coupled with a …

Read More »Oil to be monitored 21/2/2025

U.S. crude oil futures continued their upward momentum for the third consecutive session, reaching a high of $73.11 per barrel. Technical Analysis On the 4-hour chart, a bullish crossover of the simple moving averages (SMA) supports the potential for further gains. However, Stochastic indicators suggest a loss of upward momentum, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations