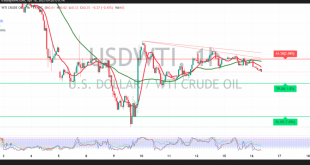

U.S. crude oil futures posted significant losses in line with the previously outlined bearish scenario, reaching the first official downside target at $60.45 and recording a session low of $60.27 per barrel. From a technical standpoint, oil prices are currently trading below the 50-day simple moving average, which is acting …

Read More »Crude Oil Breaches Support Line 22/5/2025

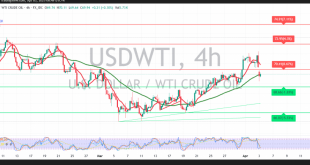

U.S. crude oil futures experienced mixed trading in the previous session after testing the psychological resistance level at $64.00, which effectively halted the upward momentum and capped further gains. Technically, oil is now stabilizing around $61.60. A closer look at the 4-hour chart reveals that the price has broken below …

Read More »Oil’s Uneasy Calm: Geopolitics and China’s Grip Tighten

Oil markets are caught in a precarious balance, teetering between geopolitical flashpoints and economic uncertainty. Despite recent easing in prices, the underlying currents of international diplomacy, military conflicts, and crucial economic data paint a complex picture for crude’s future. The current landscape isn’t merely about supply and demand; it’s a …

Read More »Oil Traders Should Monitor Price Behavior Closely 16/5/2025

U.S. crude oil futures aligned with the expected upward movement in the previous session, as the price held above the pivotal $61.20 support level. Although the market briefly dipped to $60.11, triggering a pullback that offset earlier long positions, the broader technical structure remains constructive. On the 4-hour chart, the …

Read More »Oil hovers near support, Eyes potential rebound 15/5/2025

U.S. crude oil futures are currently trading with a bearish tone, following a retreat from the recent high of $63.64 per barrel recorded in the previous session. Technically, the price is attempting to stabilize near the key support level at $61.20, suggesting the possibility of a short-term rebound. This potential …

Read More »Russian Rouble Strengthens to 10-Month High Amid Rising Oil Prices, Easing Tensions

The Russian rouble strengthened past the 81 mark against the U.S. dollar on Thursday, reaching its highest level since June 28, 2024, as climbing oil prices and geopolitical optimism fueled investor demand for the currency. As of 09:00 GMT, the rouble was trading 1.5% higher at 80.90 per dollar in …

Read More »Oil hits resistance 16/4/2025

U.S. crude oil futures are facing strong resistance near the $61.60 level, which has exerted downward pressure on prices. As a result, oil has retreated and is currently trading around $60.50 per barrel. From a technical perspective, the 50-period simple moving average—hovering near the $61.50 zone—is acting as a firm …

Read More »Oil is trying to break through the resistance 15/4/2025

U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More »Russia’s Budget Deficit Narrows in Q1 2025, But Spending Remains Elevated

Russia’s budget deficit narrowed to 1% of GDP in the first quarter of 2025, equivalent to 2.17 trillion roubles ($25.5 billion), according to a statement released by the Finance Ministry on Tuesday. This marks an improvement from the 1.3% of GDP reported in the first two months of the year. …

Read More »Oil below the moving average 3/4/2025

U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations