US crude oil futures experienced narrow-range trading, showing only a slight upward inclination and reaching a high of $66 per barrel. From a technical perspective, oil prices are attempting to recover some of the recent losses during intraday movement, with current efforts focused on stabilizing above the $65.00 level. However, …

Read More »Oil in Retreat, Heavy Selling Triggers Sharp Drop 25/6/2025

U.S. crude oil futures experienced a sharp drop yesterday, testing the psychological support level around $64.00 per barrel. From a technical perspective, intraday price action shows a modest recovery, with prices currently trading slightly above $65.00. A review of the 4‑hour chart indicates that the simple moving averages remain positioned …

Read More »Oil Attempts to Establish a Support Base 17/6/2025

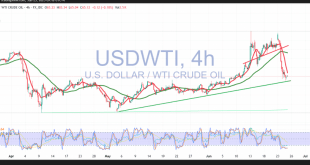

U.S. crude oil futures experienced notable fluctuations during yesterday’s trading session, primarily due to profit-taking following the sharp rally that began late last week. From a technical perspective, oil prices are attempting to establish a solid support base around the psychological level of $69.00 in order to resume the upward …

Read More »Oil May See a Relief from Overbought Conditions 16/6/2025

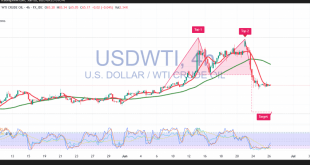

US crude oil futures posted their largest gains since March 2022, surging to a high of $77.57 per barrel as geopolitical tensions escalated, fueling fears of supply disruptions and boosting safe-haven flows into commodities. From a technical standpoint, despite the profit-taking-driven intraday pullback, the overall trend remains decisively bullish. Overbought …

Read More »Oil May Undergo Overbought Correction 12/6/2025

U.S. crude oil futures posted sharp gains in the previous session, reaching the official target of $66.85 and extending to a session high of $68.98 per barrel. From a technical standpoint, intraday price action showed signs of bearish pressure, largely attributed to profit-taking after the strong rally. This coincides with …

Read More »Oil May Extend Its Gains 11/6/2025

U.S. crude oil futures followed the expected bullish trajectory, successfully reaching the first official target at $65.90 and coming within reach of the second target at $66.45, with a session high recorded at $66.24 per barrel. From a technical standpoint, the psychological resistance near $65.00 continues to exert downward pressure …

Read More »Oil Records Notable Gains 10/6/2025

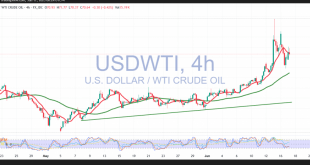

US crude oil futures extended their recent rally, posting additional gains at the start of the week and reaching a session high of $65.62 per barrel. From a technical standpoint, despite heightened intraday volatility following the recent surge, the broader trend remains bullish. A closer inspection of the 4-hour chart …

Read More »Oil Hovers Near Overbought Levels 3/6/2025

US crude oil futures surged, gaining over 3.00% and reaching a high of $63.84 per barrel. Technically, after reaching this level, price action became more volatile, but the broader daily trend remains bullish. The 4-hour chart shows that the simple moving averages continue to provide dynamic support, particularly around $61.80. …

Read More »Oil Holds Above the Support Line 29/5/2025

US crude oil futures reversed the expected downward trend outlined in the previous technical report, which was based on trading stability below the key resistance level at $61.90. Instead, the market shifted to a more positive tone, with intraday movements showing a clear upside bias. Prices are currently hovering near …

Read More »Oil Prices Face Downward Pressure 28/5/2025

U.S. crude oil futures are trading with a negative bias, despite brief intraday attempts to stabilize. The price is currently hovering near $61.20 per barrel, reflecting continued selling pressure. From a technical perspective, oil prices remain below the 50-day simple moving average, which acts as a key dynamic resistance at …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations