Despite moderating from the previous month’s notable surge, passenger car sales in China demonstrated robust growth, increasing by 8.3 percent in December. This uptick was fueled by a competitive price war among manufacturers. According to the China Passenger Car Association’s report on Tuesday, sales reached 2.37 million vehicles in December, …

Read More »Global Oil Markets Find Stability Amidst Regional Tensions and Supply Dynamics

In early Tuesday trading, oil prices experienced a stabilization following a decline in the previous session. The market found itself delicately balanced between ongoing geopolitical tensions in the Middle East and growing concerns over demand, coupled with increased oil supplies from OPEC. Brent crude futures exhibited resilience, registering a modest …

Read More »Oil maintains negative stability 9/1/2024

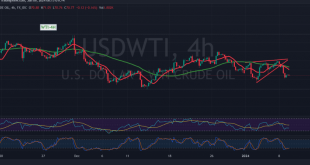

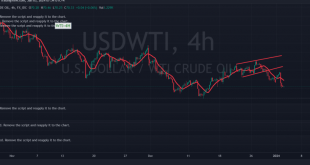

US crude oil futures prices experienced significant losses as the current week’s trading sessions commenced, aligning with the anticipated negative outlook and reaching the targeted level of $70.00. The recorded lowest level was $70.13 per barrel. Technically, the prevailing sentiment leans towards negativity, with the formation of simple moving averages …

Read More »Oil declines by more than 1%, affected by the reduction in Saudi crude prices

Oil prices experienced a decline of more than one percent on Monday, driven by significant cuts in the official selling prices for Saudi crude and an upswing in OPEC production. Despite escalating geopolitical tensions in the Middle East, these factors weighed more heavily on market sentiment. As of 0344 GMT, …

Read More »Oil rises after Fed

Oil prices rose on Friday after Federal Reserve meeting minutes indicated that inflation was under control as US Secretary of State Antony Blinken prepared for a tour of the Middle East to prevent escalation in the conflict between Israel and Gaza. By 0229 GMT, Brent crude futures rose 37 cents, …

Read More »Oil prices rise as concerns about supplies continue

Oil prices experienced a rise in early trading on Thursday, January 4, extending substantial gains from the previous session amid concerns about Middle East supplies. This surge is attributed to the shutdown of production in a field in Libya and escalating tensions due to Israel’s conflict in the Gaza Strip. …

Read More »Oil prices rise due to continued shipping tensions through the Red Sea

Oil prices experienced a slight increase in early Asian trading on Wednesday, driven by ongoing concerns about shipping disruptions in the Red Sea and escalating tensions in the Middle East. As of 0004 GMT, Brent crude rose by 26 cents, or 0.4 percent, reaching $76.11 per barrel, while US West …

Read More »Oil suffers huge losses 3/1/2024

Oil prices did not align with the positive outlook as anticipated, which was based on the assumption of trading stability above the psychological barrier support level of 71.00 at the time of the report’s issuance. The report highlighted that a return to trading stability below 71.00 would cease attempts to …

Read More »Oil begins the new year with a 1% jump

Oil prices surged by 1 percent on Tuesday, initiating the new year on a positive note. The uptick was attributed to a naval clash in the Red Sea, drawing attention to potential supply disruptions in the Middle East. Additionally, expectations of economic stimulus in China bolstered demand prospects in the …

Read More »Oil is trying to form a rising wave 2/1/2024

The most recent technical analysis report suggests that triggering selling positions hinges on breaking the 73.30 level, potentially initiating a downward trajectory for oil. In this scenario, the initial targets lie at 72.50, with the possibility of reaching its lowest point at $71.30 per barrel. From a technical standpoint, our …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations