WTI crude oil prices recorded a notable surge during the previous session, validating our previously neutral stance that highlighted a potential breakout above the minor downtrend line. The expected targets at $67.40 and $68.20 were both reached, with crude ultimately hitting a high of $69.72 per barrel. Technical Outlook: US …

Read More »Oil Attempts to Break the Downtrend Resistance 29/7/2025

U.S. crude oil (WTI) futures started the week on a positive note, attempting to establish a technical rebound after testing a key support level at $65.10 per barrel. Technical Outlook: WTI is currently holding above the psychological support of $65.00, reinforcing bullish recovery attempts. This is supported by price stability …

Read More »Technical Pressure Limits Oil’s Recovery Attempts 23/7/2025

WTI crude oil futures extended their losses during the previous session, pressured by technical selling, as prices moved closer to the first downside target at $64.70, reaching an intraday low of $64.85 per barrel. Technical Outlook – 4-Hour Timeframe: The price is currently attempting to hold above the psychological support …

Read More »Technical Pressure Weighs on Crude Oil Prices 22/7/2025

The downward trend continues to dominate U.S. crude oil futures, with intraday price action stabilizing near the recent low of $65.22. Technical Outlook – 4-Hour Timeframe: Oil remains under consistent selling pressure. A closer look at the chart shows that the 50-period Simple Moving Average (SMA) continues to act as …

Read More »Oil Attempts to Recover Losses Amid Ongoing Bearish Pressure 16/7/2025

U.S. crude oil futures extended their bearish momentum in the previous trading session, falling to a low of $66.25 per barrel. Technical Outlook – 4-Hour Timeframe: Intraday movements are showing signs of mild recovery attempts from oversold conditions. The Relative Strength Index (RSI) is attempting to generate early positive signals, …

Read More »Crude Continues to Slide as Bears Maintain Control 15/7/2025

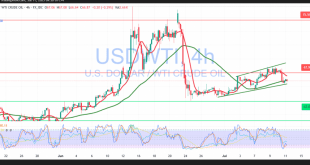

U.S. crude oil futures posted strong gains in the previous session, reaching an intraday high of $68.61 per barrel. Technical Outlook – 4-Hour Timeframe: Price action remains supported by an ascending trend line, with the simple moving averages acting as dynamic support—indicating sustained bullish momentum. Notably, a positive divergence between …

Read More »Oil Rises Supported by Positive Divergence Within an Upward Bias 11/7/2025

U.S. crude oil futures posted strong gains in the previous session, reaching an intraday high of $68.61 per barrel. Technical Outlook – 4-Hour Timeframe: Price action remains supported by an ascending trend line, with the simple moving averages acting as dynamic support—indicating sustained bullish momentum. Notably, a positive divergence between …

Read More »Oil Lacks Momentum to Confirm Bullish Trend 9/7/2025

We maintained a neutral stance in our previous report due to conflicting technical signals, clarifying that a steady break above the key resistance level at 68.00 could provide additional support for the upward movement. This has already happened, with the price successfully reaching 68.87. Technical Outlook – 4-Hour Timeframe: The …

Read More »Oil at a Crossroads: Temporary Correction or New Trend? 8/7/2025

After a sustained period of strong declines, U.S. crude oil prices staged a bullish technical rebound in the previous session, reaching a session high of $68.25 per barrel. Technical Outlook – 4-Hour ChartThe current technical landscape reveals mixed signals: The simple moving averages have shifted to provide support from below, …

Read More »Oil Prices Under Pressure — Are Further Losses Ahead? 2/7/2025

Oil prices traded cautiously higher during today’s session, following a string of consecutive declines. The market saw a modest rebound, with prices testing the psychological resistance level at $66.00 per barrel. Current Range: Support: $64.65 Resistance: $65.95 Prices remain confined within a narrow sideways range. The simple moving averages continue …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations