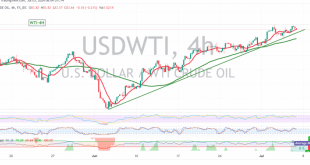

US crude oil futures prices experienced mixed trading in the previous session, encountering resistance at the 83.90 level and failing to break through. However, the price remains within the bullish context and is supported by the 50-day simple moving average around 82.50. Technical Outlook: On the 4-hour chart, the price …

Read More »WTI: Bullish Outlook Intact Despite Temporary Pullback 3/7/2024

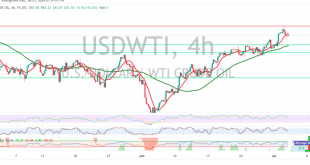

US crude oil futures prices reached our previously identified target of 84.20, peaking at $84.35 per barrel, before experiencing a slight pullback to retest the 83.00 level. Technical Outlook: Despite the recent correction, the technical outlook remains bullish. The 240-minute chart reveals that the simple moving averages (SMAs) are still …

Read More »WTI: Bullish Momentum Continues, Upside Breakout Eyed 2/7/2024

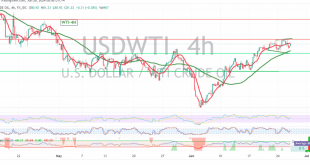

WTI crude oil futures prices surged yesterday, marking the third consecutive week of gains and reaching our previously identified target of 82.90, ultimately peaking at $83.60 per barrel. Technical Outlook: The technical outlook remains strongly bullish. The 4-hour chart reveals continued support from the simple moving averages (SMAs) for the …

Read More »WTI: Upside Potential Remains, But Breakout Needed for Further Gains 26/6/2024

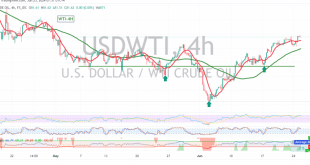

US crude oil futures prices experienced a pullback after several days of gains, failing to hold above the 81.50 resistance level and retesting the 80.60 support level. Technical Outlook: Despite the recent decline, the technical outlook remains cautiously bullish. The price is currently attempting to rebound and retest the 81.50 …

Read More »WTI: Bullish Momentum Strengthens, Eyes Further Gains 25/6/2024

US crude oil futures prices continue their impressive rally, reaching a 7-week high of $81.86 per barrel, surpassing our previously identified target of 81.60. Technical Outlook: The technical outlook remains strongly bullish. The price has established a solid support base around 79.60 and is holding above the psychologically important 80.00 …

Read More »WTI: Bullish Momentum Continues, Further Gains Anticipated 21/6/2024

WTI crude oil futures prices exhibited strong bullish momentum yesterday, successfully reaching our initial target of 81.50 and achieving a peak of $81.50 per barrel. Technical Outlook: The technical outlook remains bullish, with the 240-minute chart showing that simple moving averages (SMAs) are providing continuous support for the ongoing upward …

Read More »WTI: Cautious Bullish Outlook Amidst Upward Momentum 20/6/2024

WTI crude oil futures prices continue their upward trajectory, approaching our previously identified target of 81.30 and reaching a high of $81.13 per barrel. Technical Outlook: While the intraday movement shows some consolidation below 81.00, the overall trend remains bullish. The Stochastic indicator on the 4-hour chart is hinting at …

Read More »WTI: Bullish Momentum Strengthens, Eyes on $80 19/6/2024

WTI crude oil futures prices are on the rise, targeting the $80.00 per barrel threshold. Technical Outlook: Our analysis remains bullish, bolstered by the price finding support above the critical 79.65 level and the continued positive momentum provided by the simple moving averages. Upward Potential: The upward trend appears poised …

Read More »WTI Crude Oil Technical Analysis: Cautious Bullish Outlook Amidst Potential Gains 13/6/2024

WTI crude oil futures prices experienced notable gains yesterday, reaching our previously identified target of 78.80 and peaking at $79.28 per barrel. Technical Outlook We maintain a cautiously bullish outlook, supported by the positive influence of the 50-day simple moving average and the price holding above the crucial 77.60 support …

Read More »WTI Crude Oil Technical Analysis: Potential Shift to Bullish Trend 11/6/2024

WTI crude oil prices rebounded during the previous session, finding support at the pivotal 75.25 level we highlighted in our prior report. A break below this level would have signaled a continuation of the downward trend. On the 240-minute chart, we now observe positive crossover signals from the simple moving …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations