As the financial markets navigate the post-Labor Day landscape, the upcoming economic data releases from the United States will be a key determinant of market direction. Investors should closely monitor these reports for insights into the health of the US economy and the potential implications for monetary policy.A Data-Driven Week …

Read More »US bond yields continue to rise

US Treasury yields have continued to climb since the open, driven by market optimism following a series of positive economic data releases. Additionally, markets are eagerly awaiting the release of the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, later this week. The yield on the …

Read More »Oil Prices Poised for Weekly Gains Despite Friday Dip

Oil prices were on track for a second consecutive week of gains, despite a slight decline on Friday, driven by strong U.S. economic data that fueled optimism about demand in the world’s largest oil-consuming country. Brent crude futures have risen approximately 1.3% this week, while U.S. West Texas Intermediate (WTI) …

Read More »The US dollar continued its losing streak on Tuesday, marking the third consecutive day of declines. This weakening of the greenback is a direct reflection of the broader risk-on sentiment that has gripped financial markets. As investors digested recent economic data and eagerly awaited the crucial US inflation report, the …

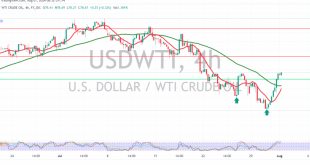

Read More »Oil makes notable gains 1/8/2024

US crude oil futures surged yesterday, reaching a high of $78.70 per barrel. Technically, the 4-hour chart indicates that oil has moved above the 50-day simple moving average, supporting a positive outlook. Additionally, the price is holding above the 78.00 support level. Given this stability, the upward trend appears likely …

Read More »Oil breaks support 30/7/2024

US crude oil futures experienced significant losses in the early trading sessions of this week, reaching the projected targets from the previous report at 76.40 and 75.95, and coming close to the next target of 75.10, with a low of $75.39 per barrel during this morning’s trading. Technically, the 4-hour …

Read More »Noor Capital | Mohammed Hashad’s Interview on Dubai TV, July 29

Dubai TV hosted Mohammed Hashad, Head of Research and Development at Noor Capital, and a member of the US Association of Technical Analysts, to comment on and shed light on market movements. United StatesThe Dow Jones saw a boost following Microsoft’s recent announcement of a new update to the Bing …

Read More »Weekly Recap: US dollar remains stagnant amid significant economic, political, and geopolitical changes

Several factors dominated market activity throughout last week, including economic data, developments in the US political landscape ahead of the 2024 presidential election, escalating geopolitical tensions in the Middle East amid the ongoing war in Gaza, and updates on the monetary policies of central banks in major economies. Economic Data …

Read More »What Could Make the Trump Presidency Mostly Bearish for Crude Oil?

Analysts predict that a second Donald Trump presidency after the election on November 5th would be generally negative for the oil market, albeit it would probably have a limited impact. Even while Trump seems to have a more pro-oil and gas agenda than a Democratic contender, it would take a …

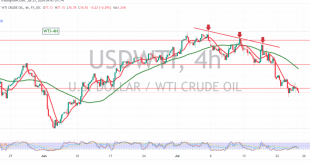

Read More »Oil: a triple top pressure the price 25/7/2024

During the previous trading session, US crude oil futures encountered a psychological resistance barrier at $78.00, which dampened the upward momentum. From a technical perspective, today’s outlook leans toward negativity, supported by a bearish technical structure on the 4-hour chart and the simple moving averages indicating ongoing negative pressure from …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations