Crude oil prices experienced mixed trading with a positive tendency, reaching a peak at $72.45 per barrel amidst ongoing geopolitical tensions. Technically, the outlook remains cautiously optimistic, with oil prices continuing to receive positive momentum from the 50-day simple moving average. This is supported by stable intraday trading above the …

Read More »Oil faces negative pressure 1/10/2024

US crude oil futures experienced significant losses, as anticipated in the previous report, reaching a low of $67.45 per barrel within the bearish trend. Technically, we maintain a cautious negative outlook, relying on the ongoing downward pressure from the simple moving averages, along with the stability of momentary trading below …

Read More »Oil extends losses 27/9/2024

U.S. crude oil futures declined significantly, following the downward trend mentioned in the previous report, exceeding the official target of 68.65 and recording a low of $66.967 per barrel. From a technical perspective, we lean toward a negative outlook but with caution, relying on the continued negative crossover of the …

Read More »Oil faces temporary negative pressure 26/9/2024

Negative pressure dominated US crude oil futures prices during last Wednesday’s trading, erasing recent gains and reaching a low of $69.28 per barrel. From a technical perspective, the outlook remains cautiously negative, influenced by the bearish crossover of the simple moving averages, which are exerting downward pressure on the price. …

Read More »Financial Markets’ Weekly Recap: Fed’s rate cut size in focus

US dollar has ceased its upward trajectory since the release of US economic data indicating a slowdown in consumer prices. This data has reinforced expectations that the Federal Reserve is likely begin cutting interest rates at its September meeting. This data has fuelled speculation that the Federal Reserve is likely …

Read More »Market Drivers; US Session, September 10

Markets Await Key US Data, Central Bank DecisionThe US dollar maintained its upward trajectory on Tuesday, although its momentum appeared to be slowing as investors cautiously awaited the release of crucial US economic data. The US Dollar Index (DXY) remained near the upper end of its trading range, hovering around …

Read More »A negative oil scenario may occur 5/9/2024

US crude oil futures extended their losses during the European trading session, reaching the first official target of $69.00 and recording a low of $68.85 per barrel. From a technical perspective, oil found solid support near $69.00, leading to some temporary gains. However, a closer look at the 4-hour chart …

Read More »Oil suffers huge losses 4/9/2024

U.S. crude oil futures experienced significant losses, surpassing the downside targets set in the previous trading session at 72.20, and recording a low of 69.75 during today’s Asian session. Technically, the 4-hour chart indicates that the bearish technical structure remains intact and effective, further reinforced by the ongoing negative pressure …

Read More »Stocks Market Meltdown: Economic Fears and Stock Market Collapse

The stock market collapsed catastrophically at the beginning of September, with the Dow Jones Industrial Average dropping by an incredible 400 points. The main causes of this sharp decline were growing economic anxieties, which were made worse by shaky manufacturing data and generalized misgivings about the technology industry.The latest market …

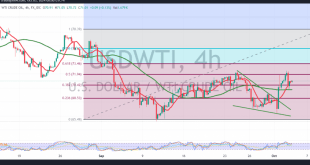

Read More »Oil: Double Top Pressures Price 3/9/2024

U.S. crude oil futures have experienced a significant decline, marking the worst monthly performance since the beginning of the year. Oil prices lost nearly 6.15% during August, reaching a low of approximately $72.90 per barrel yesterday. From a technical standpoint, the 4-hour chart reveals a bearish pattern, suggesting a continued …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations