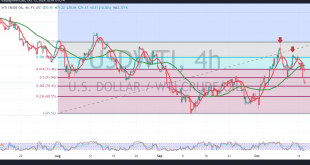

US crude oil futures prices experienced a significant decline in the last trading session, aligning with the bearish outlook, and met the forecasted targets at 68.55, hitting a session low of $67.84 per barrel. Technical Analysis: Bearish Bias: Oil prices are currently under negative pressure, with trading stability below 68.60. …

Read More »Oil settles below support 11/11/2024

US crude oil futures experienced a significant decline last week, hitting a low of $69.95 per barrel. Technical Analysis: Bearish Momentum: Oil prices are under negative pressure, with intraday trading staying below the 70.60 resistance level. The price continues to trade under the 50-day simple moving average, reinforcing the bearish …

Read More »Weekly Recap: Elections, Fed to continue as market movers for a while

Last week marked pivotal to financial markets because of the US presidential election results and the Federal Reserve’s interest rate decision. This confluence of events has the potential to significantly shape the trajectory of global asset prices and market trends for years to come. Given the far-reaching political and economic …

Read More »Oil is trying positively 31/10/2024

US crude oil futures saw a positive rebound, recovering from a low of $67.31 per barrel in the previous session. Technical Analysis: Breaching the resistance level of $68.60 has provided support for further gains. The 240-minute chart also shows the Relative Strength Index gaining positive signals, reinforcing the upward outlook. …

Read More »Oil hits target 18/10/2024

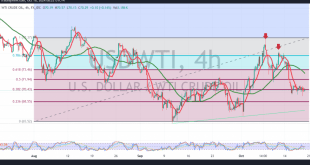

US crude oil futures have successfully reached the first downward target at $69.65 per barrel, recording a low of $69.45. Technical Outlook: Today’s analysis suggests the potential for the downtrend to continue, with the bearish double top pattern on the 4-hour chart maintaining its negative influence. The downward pressure is …

Read More »Oil: Negativity persists 17/10/2024

US crude oil futures remain in a downtrend, recording a low of $69.68, approaching the first target of $69.65 per barrel. Technical Outlook: The bearish double top pattern on the 4-hour chart continues to exert negative pressure on prices. With trading stability below $71.20, the downtrend is likely to persist, …

Read More »Oil: Negative pressure persists 16/10/2024

US crude oil futures experienced a significant decline, hitting the target of $69.65 as mentioned in the previous report, with a recorded low of $69.73 per barrel. The bearish double top pattern on the 4-hour chart continues to exert negative pressure, indicating the potential for the downtrend to persist. As …

Read More »Oil: double top pressure the price 15/10/2024

U.S. crude oil futures experienced significant losses at the start of the current week, surpassing the previous target of 71.90 and reaching a low of $70.78 per barrel. A bearish technical pattern, specifically a double top, is evident on the 240-minute chart. This, combined with persistent downward pressure from the …

Read More »What markets can expect after a volatile week

The second week of October trading began with optimism in North American equity markets despite increased Middle East tensions, ongoing war in Ukraine, a stronger than expected American economy, and weaker than expected numbers from China. China: The National Development & Reform Commission (NDRC), China’s state planner, stated that the …

Read More »Oil waiting to break support 9/10/2024

US crude oil futures experienced mixed, but mostly negative, trading after encountering strong resistance around the $78.40 level, which led to a pullback. From a technical perspective, we lean toward a bearish outlook, but with caution, as the Stochastic indicator on the 4-hour chart signals a loss of upward momentum. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations