In a high-profile television appearance, the US Interior Secretary—a vocal proponent of expanding domestic fossil fuel output—delivered a bold assessment of global oil dynamics amid rising international tensions. Drawing from his background as a former state leader in an energy-rich region, he highlighted how evolving world events are poised to …

Read More »IEA Trims 2026 Oil Surplus View as Demand Outlook Improves, Supply Growth Cools

The International Energy Agency (IEA) has revised its medium-term oil outlook, projecting a slightly tighter market in 2026 than previously anticipated, as stronger demand collides with a softer pace of supply growth. In its latest monthly report, the Paris-based agency lifted its global oil demand forecasts for both 2025 and …

Read More »Oil Prices Continue to Find Support from Geopolitical Risks

Crude oil prices saw modest support on Monday, with December West Texas Intermediate futures rising by less than 0.1%, while gasoline prices slipped about 0.6%, as geopolitical risks continued to weigh on global markets. Geopolitical tensions remain the primary driver of support for oil. Iran recently seized a tanker in …

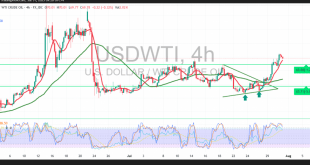

Read More »Oil Eyes Key Level – Bulls VS Bears — Can They Hold On? 15/8/2025

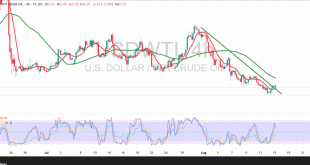

An upward trend has dominated US crude oil futures, with prices attempting to recover losses from previous sessions. Technical Outlook – 4-hour timeframe: US crude has established solid support at $62.00, while the 50-period simple moving average continues to act as dynamic resistance from above. The Relative Strength Index (RSI) …

Read More »Oil Under Pressure… Sellers Dominate the Scene 13/8/2025

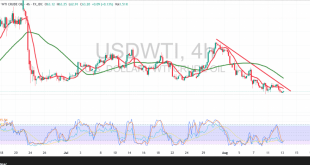

In our previous report, we maintained a bearish outlook, and US WTI crude oil futures extended their decline, recording a low of $62.97 per barrel. Technical Outlook – 4-hour timeframe: Selling pressure remains strong as prices continue to trade below the simple moving averages, which serve as a firm barrier …

Read More »Oil Slips Below $65 Resistance as Bearish Trend Takes Hold 8/8/2025

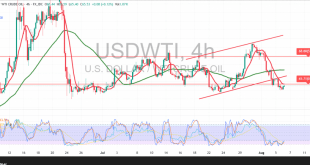

In our previous technical report, we maintained a neutral stance due to conflicting signals. However, recent price action has confirmed the continued dominance of the downtrend, with U.S. crude oil futures experiencing renewed bearish pressure in recent hours. Technical Outlook: After testing the strong psychological resistance at $65.00, prices sharply …

Read More »Crude Oil: Rebound Attempts Shadowed by Downside Risks 7/8/2025

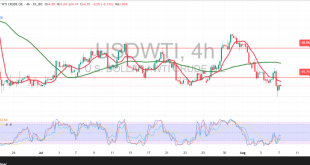

U.S. crude oil extended its losses as anticipated in our previous report, surpassing the initial downside target of $64.35 and recording a session low of $63.66 per barrel. Technical Outlook: Following multiple sessions of decline, oil prices are attempting a modest rebound, supported by price stabilization above the psychological threshold …

Read More »Oil Faces Selling Pressure 6/8/2025

U.S. crude oil futures extended their decline for the fourth consecutive session, reaching a two-week low near the $65.00 per barrel mark. Technical Outlook: Intraday price action shows a modest rebound attempt as oil tries to recover from oversold conditions. However, the 50-period Simple Moving Average (SMA) continues to act …

Read More »Crude Holds Steady — Key Support Shows Strength 1/8/2025

U.S. crude oil futures are attempting to preserve recent gains, in line with the bullish scenario outlined in our previous report. The price is gradually climbing toward the projected target of $70.70, having reached a session high of $70.40 per barrel. Technical Outlook: Current intraday price action is showing mild …

Read More »Crude Slips Briefly Amid Profit-Taking, Is More Upside Ahead? 31/7/2025

U.S. crude oil futures surged during the previous trading session, aligning with the bullish expectations outlined in our prior report. The price successfully reached the official target at $70.40, marking a session high of $70.48 per barrel. Technical Outlook: Following the recent rally, intraday movements are showing modest pullbacks, likely …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations