Gold prices were about to touch the first target at 1740, few points shy from the second target 1747, to set its highest level during the previous trading sessionn at 1745. Technically speaking, with the intraday trading remaining above 1728, accompanied by the positive stimulus of the 50-day moving average, …

Read More »Gold Rises On US Dollar Shoulders

The yellow metal prices took advantage of the decline of the US dollar to settle above the psychological barrier of 1700, as part of positive attempts to target a re-test of 1735. On the technical side today, the stability of trading above the sub-support level 1721/1720 increases the possibility of …

Read More »Gold Trying to Recover

The yellow metal prices recovered during the previous trading session, nullifying the negative outlook as we expected, in which we depended on the stability of trading below the level of 1691 touching the stop-loss order published in the previous analysis, The return of price stability above 1691, a correction of …

Read More »Gold Prices Continue to Decline

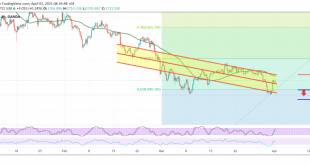

Gold prices retreated significantly within the bearish trend, as we expected, explaining that trading below 1691 extends gold’s losses, opening the way to visit 1685, recording its lowest price of 1678. Technically, and by looking at the chart, the current prices of the yellow metal are witnessing stability below the …

Read More »Gold Touches Targets And Selling Pressure Remain

After several successive sessions of sideways moves, gold prices were able to break the pivotal support level published during the previous analysis, 1720, indicating that breaking the aforementioned level puts the price under strong negative pressure, and its initial target is around 1705, to record its lowest price at 1704. …

Read More »Gold Still Looking For Confirmation

Gold prices hit the level of pivotal resistance mentioned in the previous technical, located at 1747, which forced gold to trade negatively, as the current moves witness the continued pressure on the 1723 support level. Technically, and with a closer look at the 4-hour chart, we find the 50-day moving …

Read More »Gold Waiting Pending Orders

Narrow-range sideways trading dominated gold’s movements for the second session in a row, pinging from the bottom above the support level at 1722 and from below the resistance level at 1747. Technically, we will maintain the same technical conditions, waiting for a signal to stimulate the price. With a closer …

Read More »Gold Pressing Support And Awaits More Powerful Trend

The movements of the yellow metal witnessed a negative bias, after it failed to breach the pivotal resistance published in the previous analysis at 1747, which forced it to retest 1724. Technically speaking, and with a closer look at the 4-hour chart, we find gold is turning around the 50-day …

Read More »Gold Still Looking For a More Powerful Trend

Gold prices succeeded in touching the first target required to be achieved during the previous analysis, located at a price of 1747, recording its highest level of 1747. Technically speaking, and with a closer look at the chart, we find intraday trading is stable below 1747, accompanied by the loss …

Read More »Gold Looking For a More Powerful Trend

Mixed trades are still dominating gold prices as a result of the price retreating from the bottom above the 1720 support level and from below the 1747 resistance level. On the technical side today, and by looking at the 4-hour chart, the glory of the 50-day moving average will hold …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations