Gold prices opened the morning session with a noticeable bearishness, after hitting the resistance level 1903/1905 within a bearish slope approaching retesting the main support 1880. On the technical side today, and by looking at the 240-minute chart, we find the 50-day moving average that continues to pressure the price …

Read More »Gold Based on Support And Positivity Needs Confirmation

We adhered to intraday neutrality during the previous analysis due to the conflicting technical signals, explaining that gold is trying to form a support floor around 1880, Noted that the mentioned level represents the key to protecting the bullish trend, to return to the bullish rebound again, targeting the retest …

Read More »Gold Awaiting Pending Orders

Gold prices succeeded in touching the official target published during the previous analysis, at 1856, recording a low on Friday at 1856. On the technical side, gold succeeded in forming a good support floor around 1856, which forced it to rebound upwards again, approaching retesting the previously broken support 1895. …

Read More »Gold Gives up Gains, Eyes on US Jobs Data

Gold prices achieved noticeable losses during the previous trading session after it failed to maintain trading above the 1895 level, explaining that the confirmation of breaking the mentioned level is able to pressure gold prices to visit our official target located at 1880 to record its lowest level at 1856 …

Read More »Gold Trying Positively And Looking For New Catalysts

Mixed trading dominated gold prices during the previous session’s trading, and trading is still limited from the bottom above 1894 and from the top below 1910. On the technical side today, the price stability above 1894 supports the continuation of the rise, in addition to the positive signals coming from …

Read More »Gold May Have a Temporary Decline

Gold prices succeeded in touching the first bullish target published in the previous analysis, at 1916, recording its highest level at 1916, to return again and hit the resistance level represented by our target, which forced it to trade negatively towards the retest of 1890. On the technical side today, …

Read More »Gold Touches The Desired Target And Needs Additional Determination

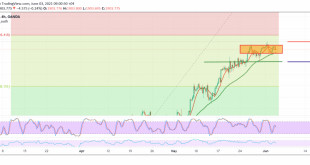

Gold prices managed to maintain their gains within the gradual upward path, touching the first target that is required to be achieved, located at the price of 1912, recording its highest level during the early trading of the current session 1912. On the technical side today, and by looking at …

Read More »Gold Maintains Positive Stability

Mixed trading dominated gold prices during the end of last week’s trading, and sideways trading is still limited from below at the support level of 1880 and from upside below the resistance level of 1905. Technically, today, and by looking at the 4-hour chart, we find that the RSI is …

Read More »Gold is Waiting For a New Move SignalS And Pending orders

Gold prices approached touching the first target required and mentioned in the previous analysis located at 1917, to settle for recording its highest level at 1912, finding it difficult to surpass the aforementioned level, which forced it to move within a bearish path. On the technical side today, and by …

Read More »Gold is Waiting For a New Move SignalS And Pending orders

Gold prices approached touching the first target required and mentioned in the previous analysis located at 1917, to settle for recording its highest level at 1912, finding it difficult to surpass the aforementioned level, which forced it to move within a bearish path. On the technical side today, and by …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations