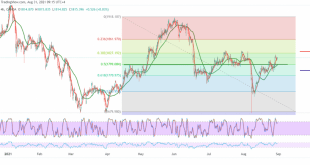

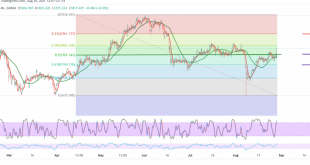

Gold prices declined noticeably during the last session after hitting the top level that was recently recorded around 1830 to retest the support floor 1799, which represents the key to protecting the bullish trend. On the technical side, today, and by looking at the 240-minute chart, we find that the …

Read More »Gold in a sideways, Eyes on US Jobs Data

Gold prices continue to move sideways for the fourth consecutive session, trying to maintain the bullish bias. Technically, and with careful consideration of the 4-hour chart, we find the 50-day moving average that supports the bullish curve in prices, in addition to the stability of trading in general above the …

Read More »Gold in a Side Track, Waiting For Pending Orders

Gold prices are witnessing sideways trading in a narrow range that tends to be positive, gradually approaching the pivotal resistance level of 1823, which was previously referred to as the key to continuing the bullish trend, recording a high of 1820. Technically, by looking at the 4-hour chart, we find …

Read More »Gold Retests Support

We stayed on the fence during the previous analysis due to the conflicting technical signals, clarifying that the pivotal support level 1799 represents the key to protecting the bullish trend. Technically, the 50-day moving average is still a hurdle and holds the price from below, coinciding with the clear positive …

Read More »Gold Awaits Pending Orders

The precious metal witnessed negative trading in the previous trading session, after two consecutive sessions of rising to retest 1807. Technically, and by looking at the 240-minute chart, we find the stochastic is trying to provide positive signals and is supported by the positive motive coming from the 50-day moving …

Read More »Gold Continues to Gain

The prices of the yellow metal jumped on Friday, supported by the statements of the Federal Reserve Chairman last Friday, to be able to breach the resistance level of 1799, heading towards touching the previous target mentioned in the previous report, at 1820. Today’s negative view indicates the possibility of …

Read More »Gold: a Bearish Technical Structure That Puts Pressure on The Price

We adhered to intraday neutrality during the previous analysis, explaining that we are waiting for confirmation of the breach of the 1790 level to activate the selling positions with an initial target of 1782 so that gold will succeed in touching the awaited target, recording its lowest level at 1782. …

Read More »Gold Presses Support And Confirms The Break

We adhered to intraday neutrality for the second session in a row, explaining that although we tend to be positive, we prefer to confirm the breach of 1808, explaining that it represents the key to protecting the bullish trend. Technically, today’s gold is witnessing stability below the mentioned resistance level. …

Read More »Gold Attacks The Resistance

We adhered to intraday neutrality during the previous report, explaining that we are waiting for gold prices to exit the transverse range from below above 1774 and from above below 1790, explaining that activating buying positions requires breaching 1790 targeting 1799 first target and then 1808 next station to succeed …

Read More »Gold is in a Sideway, Waiting For Pending Orders

We remained neutral during the report published last Friday due to the conflicting technical signals. Prices are still fluctuating within a sideways slope confined from below above the strong support level 1774 and on the downside at 1790. Technically, with careful consideration on the chart, we notice the negative pressure …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations