The technical outlook is unchanged, and there was little change in the yellow metal after it succeeded in stabilizing above the psychological barrier of 1800 within an ascending path, approaching a few points from the target published in the previous analysis at the price of 1830, recording its highest level …

Read More »Gold Breaks Through The Resistance

We adhered to intraday neutrality during the previous report, due to the conflicting technical signals, to notice the bullish rush witnessed by the yellow metal at the end of last week’s trading, and to remind us that to confirm these buying positions, it requires breaching 1799 to target 1816 to …

Read More »Gold Returns to Volatility And Focus on Employment Data

A bullish rally was witnessed in gold prices during yesterday’s session, nullifying the negative outlook as we expected. Therefore, we relied on the intraday instability below the 1799 resistance level after on the main support level 1768. On the technical side, there is a conflict between the technical signals, we …

Read More »Gold Continues to Move Negatively Against The Dollar

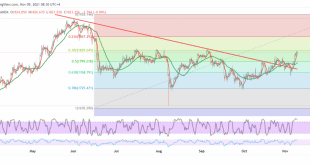

Gold prices declined significantly during the last session, touching the official stations targeted during the previous analysis at 1768 and then 1757, recording the lowest price of 1757. The technical picture indicates the possibility of continuing the decline, based on the price stability below the 50-day moving average, which still …

Read More »Gold Touches The First Target, Eyes on Fed

The pivotal resistance at 1799 managed to put selling pressure on gold prices, heading towards touching the first awaited target at 1781, recording its lowest level at 1779. Technically, we notice the continuation of the clear negative pressures on the simple moving averages, and we find the 50-day moving average …

Read More »Gold is Stable Below Resistance

Positive attempts for the yellow metal in the previous session, retesting the main resistance level at 1799, recording its highest level at 1795. Technically, and carefully looking at the 4-hour chart, we notice the 50-day moving average is still an obstacle for gold to achieve further rise. We also find …

Read More »Gold is Facing Selling Pressure

Negative trading dominated gold prices last week in the previous trading session after it failed to maintain stability above the 1799 resistance level, forcing it to trade negatively again. Technically, we tend to the negativity, according to the stability of trading below 1799, the main resistance represented by the 50.0% …

Read More »Gold is Looking For Signals

Gold prices found a strong resistance level around 1810, which forced it to trade negatively during the early trading of the current session, and it is now hovering around its lowest level during the session at 1792. Technically, and with a closer look at the 240-minute chart, we find the …

Read More »Gold is Facing Selling Pressure

The yellow metal faced selling pressure during the previous trading session; we remained neutral due to the conflicting technical signals, explaining that breaking the 1797 support level pressures the price to target 1797 and 1774, recording a low at 1782. On the technical side, today, the current moves are witnessing …

Read More »Gold Maintains Bullish Path

The yellow metal prices maintained the bullish bias after stabilizing intraday above the previously breached resistance level at 1797. Technically, by looking at the chart, we notice a conflict of technical signals between the continuation of the positive motive for the 50-day moving average, which still supports the bullish price …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations